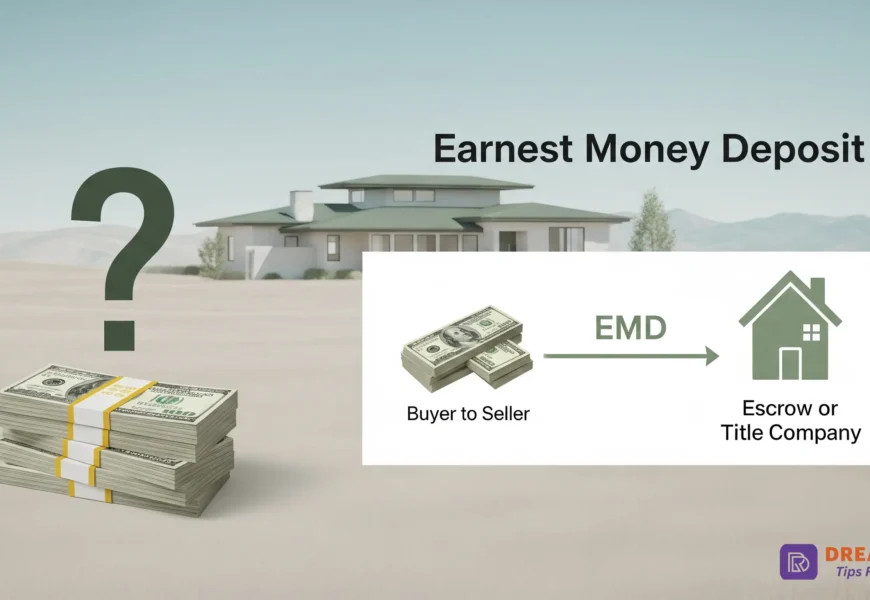

Buying a house is exciting, especially in a competitive real estate market! But between the search and the closing, there’s a step involving something called “Earnest Money” or “EMD.” It sounds official, but it’s actually pretty straightforward. Let’s break it down, focusing on the earnest money and its role in the real estate transaction.

What Exactly is an Earnest Money Deposit?

Think of EMD as your “skin in the game.” It’s a chunk of money you, the buyer, put down after your offer on a house gets accepted. It shows the seller you’re serious and not just window shopping. It’s like saying, “I really mean it, here’s some cash to prove it!”

How Does an EMD Work?

1. Offer Accepted: The buyer and seller have come to an agreement on the terms of the contract.: You find the house, make an offer, and the seller says “Yes!”

2. Putting Down EMD: Within a short time (usually 1-3 days, specified in the contract), you give the deposit to a neutral third party (like an escrow company or real estate broker’s trust account) to pay earnest money.

3. Held Safely: That neutral party holds the money safely until the deal either closes or falls apart.

4. Applied at Closing: If everything goes smoothly and you buy the house, your EMD isn’t lost! The earnest money could get applied towards your down payment or closing costs.

Why is Earnest Money Important?

Shows You’re Serious: The good faith deposit proves to the seller you’re committed and not likely to back out on a whim.

Protects the Seller: If you do back out without a valid reason (breaking the contract), the seller might get to keep your EMD as compensation for taking their house off the market.

Makes Your Offer Stronger: A solid EMD can make your offer more attractive to sellers, especially in competitive real estate transactions.

How Is Earnest Money Paid?

You typically pay it via:

Personal Check: (Sometimes acceptable for smaller amounts)

Cashier’s Check: (More secure, commonly required)

Wire Transfer: You may need to wire transfer your earnest money to the escrow account until closing.: (Often preferred for larger amounts or speed)

Crucial: Always send the good faith deposit ONLY to the verified, legitimate escrow or title company specified in your contract. Never wire money based solely on an email instruction without verifying by phone with the escrow account!

How Much Are Earnest Deposits?

There’s no fixed rule, but it’s usually 1% to 3% of the buyer and seller’s agreed purchase price in the sales contract. So, on a $300,000 house, expect an amount of earnest money held in an escrow account between $3,000 to $9,000. The amount can vary based on:

Local market customs

How hot the market is (higher in competitive areas)

What you negotiate with the seller can determine how much earnest money is required.

Protecting Your Earnest Money Deposit

1. Get Everything in Writing: Ensure all your contract contingencies (see below) are clearly spelled out.

2. Use Escrow: Make sure it goes into a licensed escrow or title company account.

3. Keep Records: Get receipts for your payment.

4. Meet Deadlines: Stick to all the dates in your contract (inspection period, financing deadline, etc.).

5. Understand Contingencies: These are your “outs” that protect your EMD.

Is an EMD Refundable?

Yes, but only under specific circumstances outlined in your contract (contingencies):

Inspection Contingency: You find major, unacceptable problems during the home inspection.

Appraisal Contingency: The house appraises for less than your offer price, which may affect the amount of earnest money refundable.

Financing Contingency: You can’t secure a mortgage loan.

Title Issues: Serious problems are found with the home’s legal ownership in the purchase contract.

Selling Your Current Home: If your contract included this contingency and your home doesn’t sell.

Is an EMD the Same as a Down Payment?

No! They are related but different:

EMD: Shows good faith upfront, held in escrow as a sum of money, applied towards your costs at closing.

Down Payment: The much larger portion of the purchase price (often 3% to 20%+) you pay at closing to secure your mortgage loan. Your EMD gets credited towards your total down payment/closing costs.

What is EMD in Real Estate? Example

Imagine you offer $400,000 on a house to buy a home. The seller accepts! Your contract states an EMD of 2% ($8,000) due within 2 days. You wire $8,000 to the title company. Later, at closing, that $8,000 is subtracted from the total cash you need to bring (which includes your full down payment and closing costs). If you backed out of the deal without a valid contingency, you’d likely lose that $8,000 in earnest money.

When is Earnest Money Due?

It’s due very soon after the seller accepts your offer and you sign the purchase agreement. The exact deadline (e.g., 1, 2, or 3 business days) is negotiated and written into the contract. Don’t miss this deadline!

What Happens to Earnest Money at Closing?

Good news! If you buy the house, your EMD isn’t gone. The escrow company applies it directly towards the buyer and seller’s agreed terms in the sales contract.

1. Your down payment, or

2. Your closing costs.

It reduces the total amount of cash you need to bring to the closing table.

Do You Get Earnest Money Back?

You get it back only if the sale falls through for a reason covered by a contingency in your contract (like failed inspection or financing). Otherwise, it gets applied to your purchase at closing.

How Do You Lose Earnest Money?

You risk losing your EMD if:

1. You Back Out Without Cause: You simply change your mind (“cold feet”) after your contingencies expire.

2. You Breach the Contract: You fail to meet a critical deadline (like the closing date) without an approved extension.

3. No Valid Contingency Applies: The reason you back out isn’t protected by the contract terms.

The Bottom Line:

An Earnest Money Deposit is your way of proving you’re a committed buyer. It protects the seller and strengthens your offer. By understanding how it works, when it’s refundable, and how to protect it (mainly through clear contingencies), you can navigate this step confidently on your path to homeownership while ensuring you keep the earnest money safe! Always review your contract carefully and ask your real estate agent or attorney if anything is unclear.

Frequently Asked Questions

1. What is an earnest money deposit (EMD) in real estate?

An EMD is a “good faith” payment made by a buyer after their offer is accepted. It shows the seller the buyer is serious about purchasing the property and is held in escrow until closing.

2. How much is earnest money usually, and how does it affect your ability to get their earnest money back?

Typically 1–3% of the purchase price (e.g., $3,000–$9,000 on a $300k home). The amount varies by market competitiveness and local customs.

3. Is earnest money refundable?

Yes, but only under specific contract contingencies, such as:

• Failed home inspection

• Low appraisal

• Mortgage denial

• Title issues

• Unsold existing home (if contingent).

Backing out without cause risks losing your EMD.

4. When is earnest money due?

Usually within 1–3 business days after the seller accepts your offer and the purchase agreement is signed. The exact deadline is written in the contract.

5. How do I pay earnest money?

Via the real estate brokerage, you can get guidance on your purchase. cashier’s check, wire transfer, or (rarely) personal check. Always send funds only to a verified escrow/title company—never directly to the seller.

6. What happens to earnest money at closing?

It’s credited toward your down payment or closing costs, reducing the cash you need to bring to the closing table.

7. Can you lose your earnest money deposit?

Yes, if you: provide a valid reason for backing out, you may be able to get your deposit back.

• Back out without a valid contingency.

• Miss critical deadlines (e.g., financing window).

• Breach the purchase contract.

8. Is earnest money the same as a down payment?

No! The EMD is a good-faith deposit (1–3%) applied at closing. The down payment is the larger cash portion (often 3–20%+) paid at closing to secure your loan.

9. How is earnest money protected?

• Use a licensed escrow/title company.

• Ensure all contingencies are in writing.

• Keep payment records, including the initial deposit for earnest money.

• Avoid wire fraud: verify account details by phone.

10. Do I get my earnest money back if the sale falls through?

Only if the contract falls through due to approved contingencies (e.g., inspection issues, financing problems). Otherwise, the seller may keep it.

11. Who holds earnest money?

A neutral third party: usually an escrow company, title company, or real estate broker’s trust account.

12. Is earnest money required?

While not legally mandatory, most sellers require it. Offers without EMD are rarely competitive.