Inheritance Property in Real Estate can feel like a mixed blessing. On one hand, it’s a valuable asset that could significantly boost your financial standing. On the other, it comes with emotional, legal, and financial complexities that can feel overwhelming. Whether you’ve inherited a family home, a rental property, or a piece of land, knowing your options is crucial to making the right decision. This guide will walk you through everything you need to know about inherited real estate, from immediate steps to long-term strategies, so you can navigate this process with confidence.

What is Inheritance Property in Real Estate?

Inheritance property refers to real estate transferred to a beneficiary after the owner’s death. This transfer occurs through a will, trust, or state intestacy laws if no estate plan exists. It can include residential homes, commercial buildings, or land, and ownership may be shared among multiple heirs.

Key Points to Know:

– Probate Process: If the deceased left a will, the property will typically go through probate—a legal process to validate the will and transfer ownership. If there’s no will, the court will decide how to distribute the property based on state laws.

– Types of Inherited Property:

– Residential homes (primary or vacation homes).

– Commercial properties (office spaces, retail buildings).

– Vacant land or undeveloped plots.

– Emotional vs. Financial Decisions: Inheriting a family home can be emotionally charged. It’s important to balance sentimental value with practical financial considerations.

Immediate Steps to Take After Inheriting Property

When you inherit property, there are a few critical steps you should take right away to protect your interests and avoid legal or financial complications.

Step 1: Confirm Ownership and Legal Rights

– Locate the will or trust documents.

– If there’s no will, the probate court will determine the rightful heirs.

– Work with an estate attorney to ensure the transfer of ownership is handled correctly.

Step 2: Assess the Property’s Condition and Value

– Hire a professional appraiser to determine the property’s market value.

– Inspect the property for any repairs or maintenance needs.

– Calculate the cost of renovations or upgrades if necessary.

Step 3: Notify Relevant Parties

– Inform banks, mortgage lenders, and insurance companies about the change in ownership.

– Update utility accounts and property tax records.

Step 4: Understand Tax Implications

– Inheritance Tax: Some states impose an inheritance tax, which varies depending on your relationship to the deceased.

– Capital Gains Tax: If you sell the property, you may owe capital gains tax on the difference between the sale price and the property’s value at the time of inheritance.

Your Options for Inherited Real Estate

Once you’ve taken the initial steps, it’s time to decide what to do with the property. Here are your main options:

Option 1: Move Into the Property

– Pros:

– Emotional connection to a family home.

– Potential tax benefits if it becomes your primary residence.

– Cons:

– Maintenance and upkeep responsibilities.

– May not be feasible if the property is far from your current location.

Option 2: Rent It Out

– Pros:

– Generates passive income.

– Property value may appreciate over time.

– Cons:

– Requires time and effort to manage tenants.

– Potential for unexpected repair costs.

Option 3: Sell the Property

– Pros:

– Immediate cash payout.

– No long-term maintenance or financial responsibilities.

– Cons:

– Capital gains tax on the sale.

– Emotional attachment may make it difficult to let go.

Option 4: Transfer Ownership

– You can gift the property to a family member or another beneficiary.

– Be aware of gift tax implications and legal transfer requirements.

Option 5: Co-Ownership or Partition Sale

– If multiple heirs are involved, you can choose to co-own the property or force a partition sale to divide the proceeds.

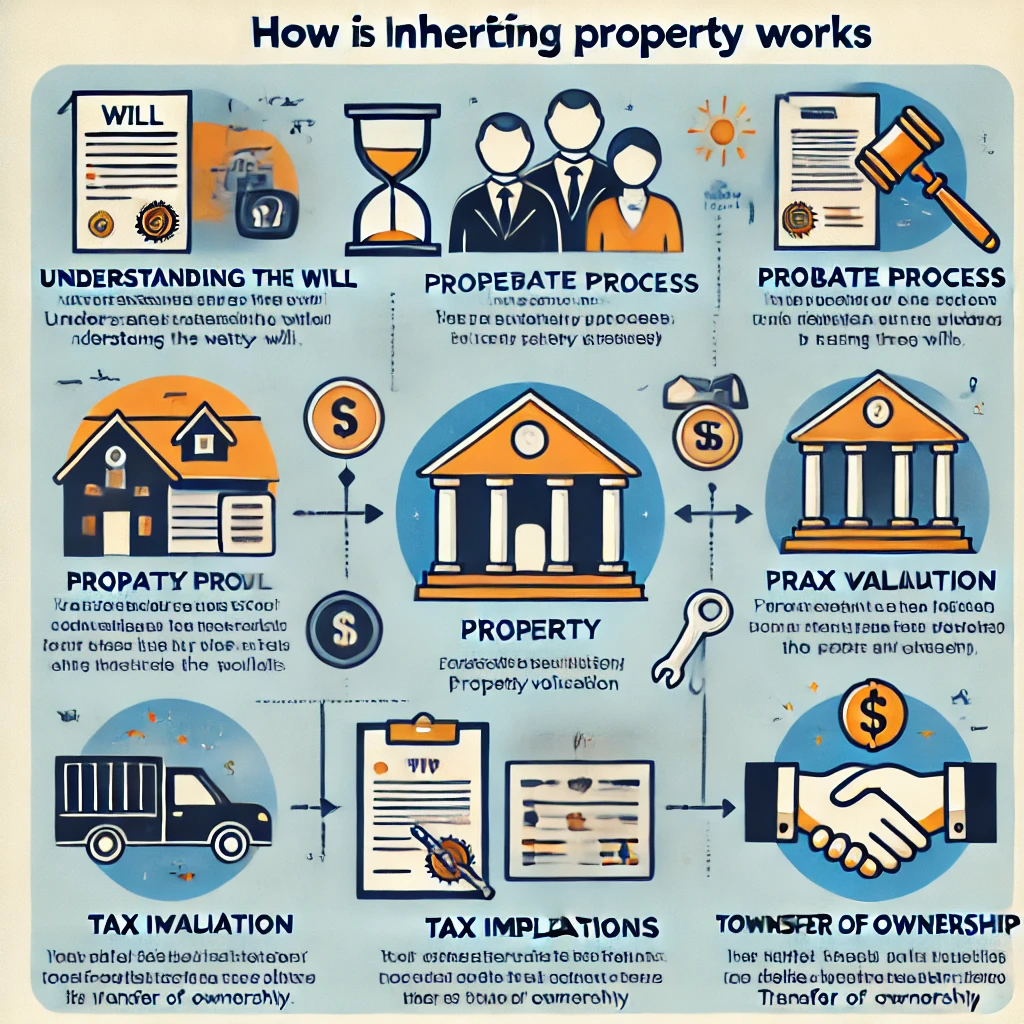

How Does Inheriting Property Work?

The process typically involves:

- Probate Court: Validates the will, appoints an executor, and transfers ownership. If no will exists, the court distributes assets according to state intestacy laws.

- Title Transfer: The deed is updated to reflect new ownership, often requiring legal documentation.

- Debt Settlement: Outstanding mortgages, liens, or taxes must be addressed before finalizing inheritance.

Examples of Inherited Property

- A family home where the deceased lived.

- A vacation property used seasonally.

- A rental apartment generating income.

- Vacant land is intended for future development.

Financial and Legal Considerations

Inheriting property often comes with financial and legal obligations that you need to address.

Mortgage and Debt on Inherited Property

– If the property has an outstanding mortgage, you’ll need to decide whether to pay it off, assume the debt, or sell the property to cover the loan.

Insurance and Maintenance Costs

– Ensure the property is adequately insured, especially if it’s vacant.

– Budget for ongoing maintenance, repairs, and property taxes.

Estate Planning and Future Considerations

– Update your own will or trust to avoid similar complexities for your heirs.

– Consider consulting a financial advisor to integrate the inherited property into your long-term financial plan.

How to Maximize the Value of Inherited Real Estate

If you decide to keep or sell the property, there are several ways to maximize its value.

Renovations and Upgrades

– Focus on improvements that offer the best return on investment (ROI), such as kitchen upgrades, bathroom remodels, or curb appeal enhancements.

– Budget carefully to avoid overspending on unnecessary renovations.

Staging and Marketing the Property

– If selling, stage the property to make it more appealing to buyers.

– Use professional photography and list the property on multiple platforms to attract potential buyers or renters.

Working with Real Estate Professionals

– Hire a reputable real estate agent, attorney, or financial advisor to guide you through the process.

– Ask questions about their experience with inherited properties and their fee structure.

Common Mistakes to Avoid

– Ignoring Tax Obligations: Failing to pay inheritance or capital gains taxes can lead to penalties.

– Underestimating Maintenance Costs: Be prepared for unexpected expenses.

– Rushing Decisions: Take your time to evaluate all options before making a decision.

– Failing to Communicate with Co-Heirs: If multiple heirs are involved, clear communication is essential to avoid disputes.

Costs Associated with Inherited Real Estate

Beyond emotional stakes, inheriting property involves financial responsibilities:

- Property Taxes: Must be paid annually, even if the property is vacant.

- Maintenance: Repairs, landscaping, and utilities.

- Insurance: Homeowners’ or liability coverage, especially if renting.

- Legal Fees: Probate, attorney, or court costs.

- Mortgage Payments: If the property isn’t paid off.

What is Inheritance Tax?

Inheritance tax (levied in some states) is paid by the beneficiary, unlike estate tax (paid by the estate). Rates vary based on the heir’s relationship to the deceased (e.g., spouses are often exempt). Check state laws, as only six states impose this tax.

Can You Avoid Capital Gains Tax on Inherited Property?

Yes, using the step-up basis: The property’s value is reset to its market price at the owner’s death. If sold immediately, capital gains tax may be minimal. Holding the property long-term could increase taxable gains if it appreciates. Consult a tax advisor for strategies like converting it into a primary residence (exempting up to 250k/250k/500k in gains).

Disadvantages of Inheriting a House

- Shared Ownership: Disagreements with co-heirs over use or sale.

- Hidden Costs: Unanticipated repairs or tax liabilities.

- Emotional Stress: Managing sentimental attachments.

- Legal Complexity: Probate delays or disputes.

Difference Between Probate and Inheritance Property

- Probate: Legal process validating a will and settling debts.

- Inheritance Property: The asset itself, transferred after probate. Not all properties go through probate (e.g., those in trusts).

Inheritance Property in Real Estate Contracts

When selling inherited property, disclose its status in purchase agreements. Buyers may request probate documentation. Title companies often require a court order to confirm legal ownership.

Inheritance Property in Real Estate Law

State laws govern inheritance rights, tax obligations, and disputes. Key considerations:

- Forced Heirship: Some states protect spouses/children from disinheritance.

- Partition Actions: Co-heirs can force a sale if disagreements arise.

Conclusion

Inheriting property requires balancing emotional and financial factors. By understanding legal obligations, tax strategies, and market options, you can make informed decisions. Consult professionals to navigate complexities and honor your loved one’s legacy effectively.

Frequently Asked Questions

Can I sell the property immediately after inheriting it?

Yes, but you may need to wait until the probate process is complete.

How is the value of inherited property determined for tax purposes?

The value is typically based on the property’s fair market value at the time of the owner’s death.

What if the property is in another state or country?

You’ll need to comply with the laws and regulations of that location, which may require additional legal assistance.

How is inherited property taxed when sold?

Capital gains tax applies to the difference between the sale price and the stepped-up basis. If sold quickly, taxes may be negligible.

Inheriting a house that is paid off

You own it outright but must still cover taxes, insurance, and maintenance. Renting or selling could generate income.

Inheriting a house with a reverse mortgage

The loan becomes due upon the owner’s death. Heirs must repay the balance (often by selling the property) or forfeit it to the lender.

Should I sell or keep my inherited house?

Consider market conditions, rental potential, emotional value, and costs. Selling provides liquidity; keeping it offers long-term equity.

How fast can I sell an inherited house?

After probate (3–12 months), you can list it immediately. Delays may occur if co-heirs dispute the sale.