Imagine walking through a bustling downtown filled with towering office buildings, vibrant shopping centers, and massive industrial warehouses. Have you ever wondered who owns these properties? The answer lies in commercial real estate industry projected to reach a staggering $30 trillion by 2025. Whether you’re a business owner, investor, or simply curious, understanding CRE is essential to grasping how cities function and economies thrive.

Brief Definition:

Commercial real estate refers to properties used for business activities or income generation, such as offices, stores, factories, apartment buildings, hotels, and hospitals. Unlike homes, these properties are meant for work, commerce, or investment purposes.

The Importance of Commercial Real Estate in the Economy and Society

Commercial real estate (CRE) is a cornerstone of economic growth and societal development. It serves as the foundation for businesses, provides investment opportunities, and supports community infrastructure. Whether it’s an office building, a retail mall, an industrial warehouse, or a mixed-use development, CRE plays a critical role in shaping the way we live and work.

Driving Economic Growth and Job Creation

At its core, commercial real estate is a powerful engine for economic expansion. Businesses depend on physical spaces to operate efficiently, whether it’s a corporate office, a manufacturing plant, or a retail storefront. The construction and maintenance of these properties create jobs in various sectors, from construction workers and architects to property managers and leasing agents. Additionally, once these spaces are occupied, businesses generate employment opportunities, fueling local and national economies. Industries such as hospitality, healthcare, and logistics rely on CRE to house their operations, reinforcing its importance in sustaining jobs and economic stability.

A Reliable Source of Income and Investment

One of the most attractive aspects of commercial real estate is its potential for income generation. Property owners and investors benefit from stable rental income from tenants, whether they are multinational corporations leasing office space or small businesses renting retail storefronts. Unlike other investments, CRE often provides consistent returns, making it a preferred choice for many investors. Moreover, as property values appreciate over time, owners can leverage their assets for further development, reinvestment, or expansion. This cycle of investment and reinvestment helps keep the real estate market dynamic and contributes to long-term financial stability.

Infrastructure Development and Urban Growth

Commercial real estate plays a vital role in shaping urban and suburban landscapes. Large-scale developments often lead to the expansion of essential infrastructure such as roads, public transportation, utilities, and broadband networks. These improvements not only make communities more accessible but also enhance the quality of life for residents and businesses. In many cases, commercial projects act as catalysts for neighborhood revitalization, attracting new businesses, increasing property values, and fostering economic activity.

Providing Spaces for Businesses to Thrive

Without physical locations to operate from, businesses would struggle to function. CRE provides the necessary spaces for enterprises of all sizes to grow and serve their customers. Retail shops, restaurants, warehouses, and office buildings create the backbone of commercial activity, ensuring that businesses can reach their target audiences. Industrial real estate, such as logistics hubs and distribution centers, plays a crucial role in supporting local and global supply chains, facilitating the movement of goods and services worldwide.

A Catalyst for Community Development

Beyond economic benefits, commercial real estate contributes to the well-being of communities by providing essential services and amenities. Shopping centers, medical facilities, schools, and entertainment venues are all forms of CRE that enrich people’s lives. These developments not only create convenience for residents but also contribute to local tax revenues, which fund public services like education, transportation, and emergency response systems. Well-planned commercial spaces can transform neighborhoods, making them more vibrant, accessible, and connected.

Encouraging Innovation and Sustainability

Modern commercial real estate is evolving rapidly, incorporating smart technology and sustainable building practices. Many new developments are designed to be energy-efficient, utilizing green building materials, solar panels, and smart systems that reduce waste and lower operational costs. Companies are also rethinking office spaces, creating more flexible work environments that encourage collaboration and productivity. These innovations not only benefit businesses but also contribute to a more sustainable future by reducing environmental impact.

Resilience During Economic Uncertainty

Commercial real estate has historically shown resilience during economic downturns, particularly when compared to other asset classes. Long-term lease agreements provide stability for landlords and investors, ensuring a steady income even in uncertain times. While certain sectors, such as retail, may experience fluctuations, other areas like industrial real estate or medical offices often remain in high demand. This stability makes CRE an attractive investment option, even during challenging economic periods.

Supporting Global and Local Commerce

The impact of commercial real estate extends beyond individual properties; it plays a crucial role in enabling trade and commerce on both local and global levels. Industrial parks and warehouses facilitate the storage and distribution of goods, making supply chains more efficient. Retail spaces provide businesses with direct access to consumers, ensuring products and services reach the market effectively. The seamless integration of CRE into commerce strengthens economies and keeps industries thriving.

Creating Social and Cultural Hubs

Many commercial properties serve as more than just business spaces—they become central gathering places where people interact, socialize, and build community connections. Shopping malls, theaters, restaurants, and co-working spaces all contribute to the cultural fabric of a city. These spaces foster engagement, entertainment, and shared experiences, making them an essential part of daily life.

Key Features of Commercial Real Estate

- Steady Income Stream – Commercial properties are usually rented out to businesses, which pay rent regularly. This helps property owners earn a consistent income.

- Long-Term Leases – Unlike homes that are rented for short periods (6–12 months), commercial spaces often have leases that last several years. This provides financial security for the owner.

- Business Tenants – The renters in commercial real estate are usually companies, such as retail stores, offices, warehouses, or healthcare facilities.

- Larger Investment, Higher Returns – Buying commercial real estate property requires more money and knowledge than residential real estate, but it often brings in bigger profits over time.

- Comparison with Residential Real Estate

| Feature | Commercial Real Estate | Residential Real Estate |

| Primary Use | Business operations | Personal living |

| Lease Duration | 3–10+ years | 6–12 months |

| Income Potential | Higher rent & ROI | Lower, more stable |

| Tenant Type | Businesses, offices | Individuals, families |

| Management | Complex, requires expertise | Simpler, can be self-managed |

Types of Commercial Real Estate

Investing in commercial real estate requires a clear understanding of different property types and their unique advantages. Whether you’re a business owner looking for the right space or an investor seeking profitable opportunities, knowing these distinctions can help you make informed decisions.

Office Buildings: The Backbone of Business

Office buildings serve as workplaces for startups, corporations, and professional services. They are typically categorized based on their quality, amenities, and location:

- Class A Offices represent the pinnacle of commercial real estate, offering state-of-the-art facilities, premium locations, and high-end amenities. These spaces often attract multinational firms and high-profile tenants.

- Class B Offices are well-maintained properties that might need minor upgrades but still provide functional and comfortable work environments. These spaces are ideal for growing businesses seeking affordability without compromising quality.

- Class C Offices are older buildings that may require significant renovations. They appeal to cost-conscious tenants willing to invest in upgrades or businesses that do not require modern aesthetics.

Retail Spaces: The Heart of Consumer Interaction

Retail properties are designed for businesses that rely on direct customer interactions, such as stores, restaurants, and shopping centers. The main types include:

- Shopping Malls, which house multiple brands under one roof, offering a mix of retail, dining, and entertainment experiences.

- Strip Malls, smaller retail complexes typically found in suburban areas, often featuring convenience stores, salons, and casual dining options.

- Standalone Stores, like grocery stores or fast-food outlets, provide independent retail spaces tailored to specific business needs.

Industrial Properties: Powering Logistics and Manufacturing

Industrial real estate plays a crucial role in manufacturing, storage, and distribution. These properties support large-scale operations and the supply chain:

- Warehouses serve as storage facilities for e-commerce businesses, wholesalers, and logistics companies.

- Manufacturing Plants are designed for production facilities, often equipped with heavy machinery and specialized infrastructure.

- Distribution Centers function as strategic hubs for moving goods efficiently across regions, ensuring timely delivery to retailers and consumers.

Multifamily Properties: Residential Investments with Potential Income

Apartment complexes with five or more units are classified as commercial properties, offering consistent rental income and long-term appreciation. Common categories include:

- Luxury Apartments, which provide premium features such as concierge services, fitness centers, and smart home technology.

- Mid-Range Apartments, which balance affordability and modern living, catering to working professionals and families.

- Affordable Housing, often subsidized by the government, ensuring accessible housing for lower-income households.

Special-Purpose Properties: Unique Investment Opportunities

Some commercial properties serve highly specific functions, making them valuable yet specialized investments. These include:

- Hotels, ranging from budget-friendly accommodations to high-end resorts, catering to travelers and tourists.

- Hospitals and Healthcare Facilities, including clinics, nursing homes, and specialty care centers, essential for community health services.

- Entertainment Venues, such as theaters, stadiums, and amusement parks, which attract large crowds and generate revenue through ticket sales and events.

Benefits of Investing in Commercial Real Estate

Investing in commercial real estate (CRE) offers significant financial rewards and long-term stability. Unlike residential properties, commercial investments provide higher income potential, stronger appreciation, and diversified opportunities. Here’s why commercial real estate remains a top choice for savvy investors:

1. Steady and Higher Income Potential

One of the biggest advantages of CRE is its ability to generate higher rental yields compared to residential properties. Commercial tenants, such as businesses and corporations, often sign long-term leases (5–10 years or more), ensuring consistent cash flow for investors. This stability reduces vacancy risks and provides a reliable income stream.

2. Appreciation and Wealth Building

Commercial properties tend to appreciate in value over time, driven by market demand, location, and economic growth. Unlike residential properties, which rely heavily on local housing trends, commercial real estate benefits from increasing business activity, infrastructure development, and inflation, making it a solid long-term investment.

3. Diversification and Risk Mitigation

Real estate investments act as a hedge against stock market volatility. Since commercial properties cater to different industries (retail, office, industrial, etc.), real estate investors can diversify their portfolios and reduce risks. Even during economic downturns, certain sectors like warehousing, healthcare, and multifamily housing continue to thrive.

4. Hedge Against Inflation

As inflation rises, so do property values and rental rates. Unlike fixed-income assets, commercial real estate provides a natural hedge against inflation because lease agreements often include rent escalations, allowing investors to keep pace with rising costs and maintain profitability.

5. Tax Advantages

Investors in commercial real estate enjoy several tax benefits, including:

- Depreciation deductions to reduce taxable income.

- Mortgage interest write-offs to lower expenses.

- 1031 Exchange benefits, which allow reinvestment into other properties without immediate capital gains tax.

These tax incentives make commercial real estate one of the most tax-efficient investment options.

6. Stronger Tenant Accountability

Commercial tenants, especially businesses, take better care of the property than residential renters. Since their reputation and operations depend on a well-maintained space, they are more likely to uphold lease agreements, cover maintenance costs, and ensure property upkeep.

7. Leverage and Scalability

With access to commercial loans and partnerships, investors can leverage their capital to acquire larger properties and scale their portfolios faster. Many CRE investments also allow for passive income through real estate investment trusts (REITs) or partnerships, making it easier to grow wealth over time.

Risks and Challenges of Investing in CRE

While commercial real estate (CRE) offers numerous benefits, it also comes with its share of risks and challenges. Investors must be aware of potential pitfalls to make informed decisions and mitigate financial risks. Here are some of the key challenges:

1. Market Volatility and Economic Downturns

Commercial real estate is closely tied to the overall economy. During economic recessions, businesses may struggle, leading to:

- Lower tenant demand, resulting in higher vacancy rates.

- Declining property values due to reduced investor confidence.

- Difficulty securing financing, as banks become more cautious with lending.

For example, the COVID-19 pandemic significantly impacted office spaces and retail properties as businesses shifted to remote work and e-commerce. Investors must adapt to market trends and choose properties that can withstand economic fluctuations.

2. Tenant Dependency and Vacancy Risks

Unlike residential properties, where multiple tenants contribute to income, commercial properties often rely on a few key tenants. If a major tenant leaves or defaults on rent, the investor may face:

- Revenue loss until a new tenant is secured.

- Increased marketing and renovation costs to attract new businesses.

- Legal and lease complications if tenants break contracts prematurely.

To mitigate this risk, investors should conduct thorough tenant screening, secure long-term leases, and diversify their tenant base where possible.

3. High Initial Investment and Financing Challenges

Investing in commercial real estate requires significant capital upfront, including:

- Large down payments (often 20-30% or more).

- Property acquisition costs, such as legal fees, inspections, and due diligence.

- Renovation and maintenance expenses before leasing the property.

Additionally, securing commercial loans can be more complex than residential mortgages. Lenders often require strong financial credentials, high credit scores, and substantial cash reserves before approving loans. Investors must assess their financial capacity and explore financing options like real estate partnerships or crowdfunding.

4. Management Complexity and Operational Challenges

Owning and managing commercial properties is more demanding than residential real estate. Common challenges include:

- Lease negotiations, which are often more complex and legally binding.

- Property maintenance, requiring compliance with safety and zoning regulations.

- Dealing with multiple stakeholders, such as tenants, vendors, and local authorities.

Many investors hire professional property management companies to handle leasing, maintenance, and legal matters. However, this adds to operational costs and impacts overall returns.

What is The Biggest Problem in Commercial Real Estate?

The biggest challenge facing commercial real estate (CRE) today is market uncertainty and evolving demand trends. Factors such as economic downturns, changing work and retail patterns, rising interest rates, and high vacancies create significant hurdles for investors and property owners.

1. High Vacancy Rates and Changing Demand

One of the biggest concerns in CRE is the declining demand for office and retail spaces. The rise of remote work and hybrid models has reduced the need for traditional office buildings, leading to higher vacancies and lower rental income. Similarly, e-commerce growth has disrupted brick-and-mortar retail, causing many shopping malls and storefronts to struggle.

🔹 Example: Many corporate tenants are downsizing their office spaces, while major retailers are shifting to online sales, leaving commercial landlords scrambling to repurpose vacant properties.

2. Rising Interest Rates and Financing Challenges

Commercial real estate is highly dependent on debt financing, and rising interest rates increase borrowing costs, making property purchases and refinancing more expensive. This affects:

✔ Property valuations—higher rates can lead to lower property prices.

✔ Cash flow—higher mortgage payments reduce profits.

✔ Investment activity—fewer deals occur as financing becomes more expensive.

🔹 Example: A real estate investor who secured a low-interest loan in 2020 may struggle to refinance at today’s higher rates, increasing financial pressure.

3. Economic Uncertainty and Recession Risks

Commercial real estate is vulnerable to economic downturns, which impact business profitability, tenant stability, and leasing activity. If businesses struggle, they may:

✔ Downsize or close locations, leading to vacancies.

✔ Delay expansion, reducing demand for office and industrial spaces.

✔ Renegotiate leases at lower rates, affecting rental income.

🔹 Example: During recessions, retail and hospitality properties often suffer as consumer spending declines, forcing landlords to lower rents or offer incentives to retain tenants.

4. Property Repurposing and Adaptation Costs

As demand shifts, property owners must adapt spaces to meet new needs, which can be costly and time-consuming. Converting vacant office buildings into residential units or repurposing malls into mixed-use developments requires:

✔ Major renovations and zoning approvals.

✔ Significant capital investment.

✔ Market research to ensure long-term demand.

🔹 Example: Some investors are turning vacant office buildings into apartment complexes to address housing shortages, but such conversions require substantial modifications and regulatory approvals.

How to Invest in Commercial Real Estate

Commercial real estate (CRE) offers a variety of investment opportunities, each with different levels of involvement, risk, and return potential. Whether you want to own properties directly or take a more passive approach, here are the main ways to invest in CRE:

1. Direct Investment: Owning Properties Outright

For investors looking for full control and long-term wealth building, directly purchasing commercial properties is a traditional approach. This involves buying office buildings, retail spaces, industrial warehouses, or multifamily apartment complexes.

🔹 Pros:

✔ Potential for high rental income and property appreciation.

✔ Full control over property management and tenant selection.

✔ Tax benefits, such as depreciation and mortgage interest deductions.

🔹 Cons:

❌ Requires significant upfront capital and financing.

❌ Property management can be time-consuming and complex.

❌ Higher risk due to vacancies or market downturns.

Direct investment is best suited for those with experience in real estate or access to strong financial resources and professional property management.

2. Real Estate Investment Trusts (REITs): Passive and Liquid Investment

For those who want exposure to commercial real estate without managing properties, Real Estate Investment Trusts (REITs) are a great option. REITs are companies that own and manage income-producing commercial properties. Investors buy shares in a REIT, similar to stocks, and earn dividends from rental income.

🔹 Pros:

✔ Low capital requirement—start investing with as little as a few hundred dollars.

✔ Highly liquid—you can buy and sell shares easily.

✔ Diversification—REITs own multiple properties across different sectors (e.g., offices, malls, healthcare).

🔹 Cons:

❌ Less control over property decisions.

❌ Market-dependent—REIT share prices fluctuate like stocks.

❌ Dividends are taxed as ordinary income.

REITs are ideal for passive investors seeking steady returns without the hassle of property ownership.

3. Partnerships and Syndications: Pooling Resources with Other Investors

For those who want to invest in commercial real estate but lack the full capital or expertise, partnerships and syndications provide a collaborative approach. Investors pool funds to purchase large commercial properties, with a general partner managing the investment and limited partners contributing capital.

🔹 Pros:

✔ Access to larger, high-value properties with lower personal investment.

✔ Shared risk and responsibilities among multiple investors.

✔ Passive income potential if you’re a limited partner.

🔹 Cons:

❌ Less control over decision-making (for limited partners).

❌ Profits are split among investors.

❌ Requires trust in the managing partner’s expertise.

This option is great for investors who want exposure to commercial properties but prefer a hands-off approach.

4. Crowdfunding: Accessible and Flexible Real Estate Investing

Real estate crowdfunding platforms allow investors to contribute small amounts of capital to commercial real estate projects in exchange for a share of the returns. These platforms connect investors with developers seeking funding for new or existing properties.

🔹 Pros:

✔ Low entry barrier—some platforms allow investments as low as $500.

✔ Opportunity to invest in diverse property types across different markets.

✔ No property management responsibilities.

🔹 Cons:

❌ Less liquidity—investments may be locked in for years.

❌ Returns depend on the success of the project and platform.

❌ Some platforms are limited to accredited investors.

Crowdfunding is an excellent way for new investors to enter the commercial real estate market with minimal capital.

What is the Most Profitable Commercial Real Estate?

The profitability of commercial real estate (CRE) depends on location, market trends, tenant demand, and property management. However, certain property types tend to offer higher returns and long-term stability. Here are the most profitable commercial real estate sectors:

1. Multifamily Properties: Consistent Rental Income & Appreciation

Why It’s Profitable:

✔ Steady demand—People always need housing, making multifamily buildings recession-resistant.

✔ Multiple income streams—Even if one unit is vacant, others generate rent.

✔ Value appreciation—Well-maintained properties increase in value over time.

Profitability Factors:

🔹 Luxury Apartments: Higher rental income but require premium locations.

🔹 Mid-range & Workforce Housing: Strong demand with lower vacancy risks.

🔹 Affordable Housing: Government subsidies provide stable income.

Average Returns: 8%–12% annual return through rental income and property appreciation.

2. Industrial Real Estate: High Demand from E-Commerce & Logistics

Why It’s Profitable:

✔ E-commerce boom—Companies like Amazon and Walmart drive demand for warehouses and distribution centers.

✔ Long-term leases—Industrial tenants typically sign 5- to 15-year leases, ensuring stable cash flow.

✔ Lower maintenance costs compared to office and retail properties.

Profitability Factors:

🔹 Warehouses & Fulfillment Centers: High demand from online retailers.

🔹 Cold Storage Facilities: Growing due to food and pharmaceutical industries.

🔹 Manufacturing Plants: Stable long-term tenants but location-dependent.

Average Returns: 10%–15% annual return, depending on market location.

3. Self-Storage Facilities: Low Overhead & High Cash Flow

Why It’s Profitable:

✔ Minimal maintenance—Unlike apartments or offices, self-storage requires fewer repairs.

✔ Low operating costs—Limited staffing and lower upkeep costs.

✔ High occupancy rates—People and businesses need extra storage space, even during recessions.

Profitability Factors:

🔹 Urban Areas: High demand but competitive.

🔹 Suburban Markets: Growing need for storage near residential communities.

🔹 Climate-Controlled Units: Higher rental rates.

Average Returns: 8%–15% annual return, with strong cash flow.

4. Medical Office Buildings: Stable Tenants & Long Leases

Why It’s Profitable:

✔ Healthcare demand is recession-proof—Hospitals, clinics, and specialty practices always need space.

✔ Long-term leases—Medical tenants often sign 10- to 20-year leases.

✔ Low vacancy risk—Specialized medical facilities are difficult to relocate.

Profitability Factors:

🔹 Dental & Specialty Clinics: Consistent demand and high tenant stability.

🔹 Surgical & Imaging Centers: Premium rental rates.

🔹 Urgent Care Centers: Growing demand in suburban and urban areas.

Average Returns: 7%–12% annual return, depending on location and specialization.

5. Mixed-Use Developments: Multiple Income Streams

Why It’s Profitable:

✔ Diverse revenue sources—Combines residential, retail, and office spaces for multiple income streams.

✔ Efficient land use—Higher rental yield per square foot.

✔ Urban revitalization—Cities encourage mixed-use projects for community growth.

Profitability Factors:

🔹 High-foot traffic areas: Ensures steady business for commercial tenants.

🔹 Live-Work-Play Communities: Attracts residents seeking convenience.

🔹 Tourist-Friendly Zones: Maximizes retail and short-term rental income.

Average Returns: 8%–14% annual return, based on location and tenant mix.

How to Purchase Commercial Real Estate

Purchasing commercial real estate (CRE) involves a more complex process compared to buying residential properties, as it requires careful planning, financial analysis, and a strategic approach. Below is a step-by-step guide to help you navigate the CRE purchase process.

1. Define Your Investment Criteria

Before diving into the market, it’s important to define what you want to purchase. Consider the following:

- Property Type: Office buildings, retail spaces, industrial properties, multifamily units, or mixed-use developments.

- Location: Urban, suburban, or rural areas? Proximity to transportation, businesses, and amenities can affect the property’s profitability.

- Investment Strategy: Are you looking for long-term rental income, capital appreciation, or a fix-and-flip project?

- Budget: Know how much capital you can invest, including down payment, closing costs, and potential renovations.

Pro Tip: Conduct thorough market research to understand demand, rental rates, and vacancy trends in the area.

2. Get Pre-Approved for Financing

CRE purchases usually involve substantial amounts of money, so most investors rely on financing. Getting pre-approved helps you understand your budget and shows sellers you are serious.

✔ Types of Financing Options:

- Traditional Bank Loans: Often require a strong credit score and a significant down payment (usually 20%–30%).

- Commercial Mortgage-Backed Securities (CMBS): Loans bundled into securities that can be sold to investors.

- Private Equity: An investment firm provides capital in exchange for equity or a share of the profits.

- SBA Loans (Small Business Administration): For owner-occupied commercial properties, offering favorable terms.

- Seller Financing: The seller acts as the lender, providing you with a loan instead of a bank.

Pro Tip: Work with a financial advisor or mortgage broker to find the best loan options for your situation.

3. Hire a Commercial Real Estate Broker

A CRE broker can help you find suitable properties and negotiate favorable terms. They have access to off-market deals, market knowledge, and professional networks that will streamline your search.

✔ Choose a Broker Specializing in Your Property Type:

- Office buildings

- Retail and shopping centers

- Multifamily apartment complexes

- Industrial properties

Pro Tip: Select a broker with local market expertise to ensure they understand the area and have connections to potential sellers.

4. Analyze Property Financials

Once you identify a potential property, carefully evaluate its financial performance to ensure it will generate a positive return on investment (ROI).

✔ Key Metrics to Review:

- Net Operating Income (NOI): The property’s revenue after operating expenses, but before debt service and taxes.

- Cap Rate: The ratio of NOI to the property’s value or purchase price.

- Cash Flow: The actual income you’ll receive from the property after expenses and mortgage payments.

- Debt Service Coverage Ratio (DSCR): Measures your ability to cover debt payments with property income.

Pro Tip: If possible, request the last 2–3 years of financial statements from the seller to assess performance trends.

5. Conduct Due Diligence

Due diligence is the process of thoroughly investigating the property before committing to the purchase. This ensures there are no hidden issues that could affect your investment.

✔ Important Due Diligence Steps:

- Property Inspection: Hire professionals to check the building’s condition, including structural issues, plumbing, HVAC, and electrical systems.

- Title Search: Ensure the property has a clear title with no outstanding liens or legal issues.

- Zoning & Permitting: Verify the property is properly zoned for your intended use and that necessary permits are in place.

- Lease & Tenant Review (for income-producing properties): Review lease agreements and the stability of existing tenants.

Pro Tip: Engage real estate attorneys and property inspectors to help with the legal and technical aspects.

6. Make an Offer & Negotiate Terms

Once you’ve completed due diligence and are satisfied with the property, you can make an offer. Typically, this involves submitting a letter of intent (LOI) or an offer to purchase that outlines your proposed terms.

✔ Key Negotiation Points:

- Purchase price and potential seller concessions.

- Closing timeline and contingencies (e.g., financing, inspection results).

- Seller responsibilities (repairs, tenant retention, etc.).

Pro Tip: If you’re new to CRE transactions, consider working with an experienced attorney to help craft and review the purchase agreement.

7. Secure Financing and Close the Deal

Once the terms are agreed upon, you’ll need to finalize your financing and schedule the closing. At this stage:

- Submit the loan application and provide all necessary documents (financial statements, tax returns, etc.).

- Ensure the title company prepares all paperwork and that you have title insurance for protection.

- Confirm the final closing costs (e.g., appraisal fees, legal fees, transfer taxes).

Pro Tip: Before closing, review all disclosures and final contracts with your legal and financial team to ensure everything is in order.

8. Close the Deal and Take Ownership

Once all terms are met, the closing process will involve signing documents, transferring funds, and receiving the property title. After closing:

✔ Collect keys or access to the property.

✔ Ensure proper documentation is filed with local authorities.

✔ Begin property management or lease-up if applicable.

Pro Tip: After closing, conduct a final walk-through to ensure the property is in the agreed-upon condition.

What is Commercial Insurance

Commercial insurance refers to a range of insurance policies designed to protect businesses from financial losses due to various risks and unforeseen events. It is specifically tailored for commercial properties, operations, and liability risks. Commercial insurance is essential for business owners to safeguard their assets, employees, and operations from potential damages or legal claims.

Types of Commercial Insurance

- Property Insurance

- Covers: Physical damage to the business property, such as buildings, equipment, inventory, and furniture.

- Example: If a fire damages your office building, property insurance would cover the repair costs or replacement.

- General Liability Insurance

- Covers: Third-party claims for bodily injury, property damage, or advertising mistakes.

- Example: If a customer slips and falls on your business premises, general liability insurance would cover medical costs and legal expenses.

- Professional Liability Insurance (Errors & Omissions Insurance)

- Covers: Claims related to professional advice or services, such as negligence or errors in service.

- Example: If a consultant provides faulty advice that leads to financial loss for a client, this insurance would cover legal fees and damages.

- Workers’ Compensation Insurance

- Covers: Medical and rehabilitation expenses for employees who are injured at work.

- Example: If an employee gets injured while using machinery, workers’ compensation would cover their medical bills and lost wages.

- Business Interruption Insurance

- Covers: Loss of income and ongoing expenses if the business is temporarily unable to operate due to an event like a natural disaster.

- Example: If a hurricane destroys your store, business interruption insurance can help replace lost income while the business is being repaired.

- Commercial Auto Insurance

- Covers: Vehicles owned or used by the business for transportation or deliveries.

- Example: If a delivery truck is in an accident, commercial auto insurance would cover vehicle repairs, medical expenses, and third-party liability.

- Cyber Liability Insurance

- Covers: Data breaches, cyberattacks, or loss of sensitive customer information.

- Example: If a hacker gains access to your customer database, cyber liability insurance can help cover legal fees, notifications, and recovery costs.

- Directors and Officers Insurance (D&O Insurance)

- Covers: Legal costs and damages arising from decisions made by company executives that negatively affect the business or stakeholders.

- Example: If a shareholder sues the board of directors for mismanagement, D&O insurance would cover legal expenses and any settlements.

- Flood Insurance

- Covers: Damage caused by floods, typically excluded in standard property insurance policies.

- Example: If your office is flooded due to a nearby river overflow, flood insurance would cover the damage to property and equipment.

Why Do You Need Commercial Insurance?

- Financial Protection: It helps cover the costs associated with property damage, lawsuits, and other business risks.

- Legal Requirements: Certain types of insurance, like workers’ compensation, are legally required in many jurisdictions.

- Risk Mitigation: It provides a safety net to ensure your business can recover from unexpected events or liabilities without severe financial strain.

How to Buy Commercial Real Estate with No Money

Buying commercial real estate (CRE) without using your own money can seem challenging, but there are several creative financing strategies and options available to make this possible. While these methods may require more effort, networking, and negotiation, they can help you leverage other people’s money (OPM) to invest in commercial property.

Here are some of the most common ways to buy commercial real estate with no money down:

| Method | Description | How It Works | How to Make It Work |

| Seller Financing | The seller acts as the lender, and you make monthly payments directly to them. | – Negotiate purchase price, interest rate, and repayment terms with the seller. – Bypass traditional banks. | – Negotiate a low or no down payment. – Look for motivated sellers willing to finance the deal. |

| Lease Option | Rent the property with the option to purchase later. | – Sign a lease with an option to buy at a predetermined price. – Some rent may apply toward the purchase price. | – Negotiate terms that allow you to build equity over time. – Use lease period to improve property value. |

| Partnering with Investors (Joint Venture) | Partner with investors who provide capital, and you provide expertise. | – You bring the expertise; investors provide the capital. – Profits (or losses) are shared based on the agreement. | – Network with investors for capital. – Showcase your skills and ability to manage the property effectively. |

| Real Estate Syndication | Pool funds from multiple investors to buy a commercial property. | – As the syndicator, you manage the property, and investors contribute capital. – Investors receive passive returns. | – Use your network to find investors. – Offer a strong business plan and clear investment opportunities. |

| Hard Money Loan | Short-term loan from a private lender, secured by the property. | – Loans are secured by the property’s value, not your personal credit. – Higher interest rates and shorter terms than traditional loans. | – Use for short-term acquisitions or quick renovations. – Ensure a solid exit strategy (e.g., refinancing or selling). |

| Crowdfunding | Pool funds from multiple investors via crowdfunding platforms. | – Raise capital from a group of small investors. – Platforms like Fundrise, RealtyShares, or CrowdStreet facilitate CRE investments. | – Participate as a passive investor or raise funds for a property purchase. – Do due diligence on platforms. |

| Self-Directed IRA | Use retirement funds (IRA) to invest in commercial real estate. | – Transfer funds into a self-directed IRA (SDIRA), which can invest in CRE. – Profits and income go back into the IRA. | – Work with an IRA custodian. – Ensure compliance with IRS rules. |

| Assume Existing Mortgage | Take over the seller’s mortgage payments without obtaining a new loan. | – Assume the seller’s mortgage payments but have the title transferred to you. – The original loan remains in the seller’s name. | – Negotiate terms with the seller. – This strategy requires trust and cooperation from both the seller and lender. |

How to Sell Commercial Real Estate

Selling commercial real estate involves several key steps to ensure that the process is smooth, efficient, and maximizes the value of the property. Here’s a breakdown of the typical steps involved in selling commercial real estate:

- Prepare the Property

- Set the Right Price

- Market the Property

- Negotiate Offers

- Accept an Offer

- Due Diligence

- Close the Deal

- Post-Sale

Key Metrics and Analysis

Investing in commercial real estate requires more than just selecting a property—you need to analyze its financial performance to ensure profitability. Several key metrics help investors assess potential returns, risk levels, and financing options. Here’s a breakdown of the most important ones:

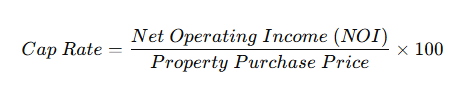

1. Capitalization Rate (Cap Rate): Measuring Property Yield

The Cap Rate is one of the most commonly used metrics in commercial real estate. It measures the return on investment (ROI) based on the property’s net income and purchase price.

🔹 Formula:

🔹 Why It Matters:

✔ Helps compare different properties within the same market.

✔ Indicates potential return—higher cap rates suggest higher risk and reward, while lower cap rates indicate stability.

✔ Useful for evaluating market trends and property valuations.

Example: If a property generates $100,000 NOI and is purchased for $1,000,000, the cap rate is 10%. A higher cap rate may indicate a better return but could also mean higher risk.

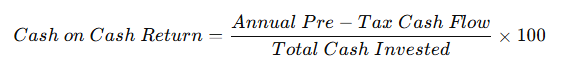

2. Cash on Cash Return: Evaluating Investment Performance

Cash on Cash Return measures how much cash an investor earns annually relative to the cash invested (out-of-pocket expenses). It helps determine how efficiently an investment generates cash flow.

🔹 Formula:

🔹 Why It Matters:

✔ Provides a clear picture of actual returns, considering financing.

✔ Helps investors compare different properties based on cash flow.

✔ Useful for investors using leverage (mortgages) instead of outright purchases.

Example: If an investor puts down $200,000 and earns $20,000 in cash flow per year, the Cash on Cash Return is 10%. A higher percentage suggests better short-term returns.

3. Net Operating Income (NOI): Assessing Property Profitability

NOI represents a property’s total revenue minus all operating expenses, excluding loan payments. It measures how much income a property generates before debt servicing.

🔹 Formula:

🔹 Why It Matters:

✔ Essential for determining a property’s true profitability.

✔ Used in Cap Rate and DSCR calculations to assess investment potential.

✔ Helps investors make informed decisions on property acquisitions.

Example: If a property generates $150,000 in rent and incurs $50,000 in expenses, the NOI is $100,000. Investors focus on increasing NOI to enhance property value.

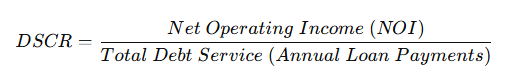

4. Debt Service Coverage Ratio (DSCR): Loan Eligibility Indicator

DSCR measures a property’s ability to cover its debt obligations. Lenders use this metric to determine if a property generates enough income to support loan payments.

🔹 Formula:

🔹 Why It Matters:

✔ Lenders require a DSCR above 1.2 for approval—this means the property generates 20% more income than needed for debt payments.

✔ A higher DSCR (1.5 or above) indicates a safer investment with lower financial risk.

✔ A DSCR below 1.0 means the property doesn’t generate enough income to cover loan payments, signaling financial distress.

Example: If a property has $100,000 NOI and $80,000 in annual loan payments, its DSCR is 1.25, which most lenders consider acceptable.

How to Find Buyer for Commercial Real Estate Property

Selling a commercial real estate (CRE) property requires strategic marketing, networking, and leveraging professional resources to attract qualified buyers. Whether you’re selling an office building, retail space, or industrial property, here are the best methods to find the right buyer:

1. List Your Property on Commercial Real Estate Marketplaces

Online listing platforms provide high visibility to investors and business owners actively searching for properties.

✔ Top CRE Listing Websites:

- LoopNet (Largest marketplace for commercial real estate)

- CoStar (Premium platform for serious investors)

- Crexi (User-friendly with a large investor base)

- Realtor.com Commercial (Great for reaching general real estate buyers)

- Brevitas (Exclusive marketplace for off-market deals)

Pro Tip: Use high-quality images, a detailed property description, financials (NOI, Cap Rate, Lease Info), and location highlights to attract buyers faster.

2. Work with a Commercial Real Estate Broker

Hiring a commercial real estate broker provides access to an extensive network of buyers and helps negotiate better deals.

✔ Benefits of Using a Broker:

- Access to pre-qualified buyers actively looking for investment opportunities.

- Expertise in pricing, marketing, and handling negotiations.

- Saves time by handling inquiries, property tours, and paperwork.

Pro Tip: Look for a broker specializing in your property type and location. For example, an industrial property broker will have a different network than a retail-focused broker.

3. Target Investors and Real Estate Funds

Many real estate investment firms, REITs, and private investors are always looking for profitable commercial properties.

✔ How to Find Investors:

- Contact local real estate investment groups or commercial real estate meetup events.

- Reach out to REITs (Real Estate Investment Trusts) or private equity firms investing in CRE.

- Post on LinkedIn and professional real estate forums to attract investor interest.

Pro Tip: Offer detailed financial reports (NOI, cash flow projections, DSCR) to show why your property is a great investment.

4. Market to Business Owners and Franchise Operators

If your property is zoned for retail, office, or industrial use, market directly to businesses looking to expand or relocate.

✔ Where to Find Business Buyers:

- Franchise directories (Many franchises need new locations).

- Chamber of Commerce networks (Local business owners seeking properties).

- Business-for-sale websites (BizBuySell, BusinessesForSale).

Pro Tip: Highlight how your property benefits their business (traffic, demographics, zoning approvals).

5. Utilize Email Marketing & Social Media

Email marketing and social media campaigns can directly target investors and business buyers.

✔ Where to Promote:

- LinkedIn & Facebook Groups (Commercial real estate investment groups)

- Instagram & Twitter (Real estate hashtags & paid ads)

- Email Lists (Use CRE databases like PropertyShark or Reonomy to send targeted emails)

Pro Tip: Run paid ads on Facebook and Google with keywords like “Commercial Property for Sale in [City]” to reach buyers quickly.

6. Host Property Tours and Investment Webinars

Hosting exclusive property tours or virtual presentations can help you attract serious buyers.

✔ How to Do It:

- Schedule in-person investor walkthroughs.

- Host a webinar (Showcase the property, financials, and market trends).

- Invite brokers and investors to a private Q&A session.

Pro Tip: Offer drone videos and 3D virtual tours to impress remote buyers.

7. Offer Seller Financing or Incentives

Some buyers may need flexible financing options to close the deal. Offering seller financing or incentives can make your property more attractive.

✔ Options to Consider:

- Seller Financing: Let the buyer make monthly payments instead of securing a loan.

- Lease-to-Own: Attract buyers who may need time to secure financing.

- Discounted Price for Cash Buyers: Speed up the sale process.

Pro Tip: Offering flexible terms can attract more serious buyers who may not have access to immediate financing.

What is Commercial Property

Commercial property is buildings and land that are intended for profit-generating activities rather than regular residential purposes

Which is An Example of a Commercial Property?

An example of a commercial property is a shopping mall. Shopping malls are designed to accommodate a variety of retail stores, restaurants, and service-oriented businesses, providing space for both large and small businesses to operate. These properties are typically leased out to tenants, and the income generated from the leases is a primary source of revenue for the property owner or investor.

Key Features of a Shopping Mall (Commercial Property):

- Retail spaces: For clothing stores, electronics outlets, or beauty salons.

- Common areas: Public spaces like food courts, walkways, and parking lots.

- Multiple tenants: A shopping mall often houses many different businesses under one roof.

- Income generation: The mall owner earns revenue through rent and potentially a percentage of tenant sales.

What are Escalations in Commercial Real Estate

In commercial real estate, escalations are rent increases built into lease agreements to keep rental income aligned with factors like inflation, market changes, or rising property costs.

- Fixed Escalation: Rent increases by a set amount or percentage (e.g., 5% annually) at regular intervals. It’s predictable but may not match market or inflation changes.

- CPI Escalation: Rent increases based on the Consumer Price Index (CPI), which tracks inflation. It adjusts rent according to inflation but can cause fluctuating increases.

- Operating Expense Pass-Throughs: Tenants pay a share of increased operating costs (e.g., property taxes, insurance) on top of rent. This keeps rent lower but can lead to unpredictable costs.

- Market Rent Escalation: Rent adjusts based on current market rates for similar properties, typically every 3–5 years. It keeps rent aligned with the market but can result in significant increases.

- Step-Up Rent Escalation: Rent increases in set steps over time (e.g., $1/sq ft every year). It offers predictability but may eventually exceed market rates.

Escalations protect landlords from rising costs and help tenants plan for rent changes over time.

What Does Special Purpouse Mean in Commercial Real Estate

n commercial real estate, a special purpose property refers to a building or facility that is specifically designed and constructed for a unique, singular use, often making it unsuitable for general-purpose use or easy repurposing without significant modifications. These properties are typically tailored for a particular business or operation, and their value is primarily tied to that specialized use.

Examples of special purpose properties include:

- Hotels

- Gas stations

- Medical facilities (e.g., hospitals, clinics)

- Religious buildings (e.g., churches, synagogues)

- Schools and universities

- Amusement parks and stadiums

- Funeral homes

- Industrial facilities (e.g., foundries, certain manufacturing plants)

What Does Specialty Mean in Commercial Real Estate

In commercial real estate, specialty refers to properties that are designed for specific uses or markets, but unlike special purpose properties, they are typically more flexible and adaptable for different tenants or businesses. While specialty properties serve a particular niche, they can often be repurposed or used by different types of businesses, albeit still within a specialized function or industry.

Examples of specialty properties include:

- Data centers

- Cold storage warehouses

- Cinemas or theaters

- Auto repair shops

- Bowling alleys

- Fitness centers

- Self-storage facilities

How Do You Get A Commercial Real Estate License

Getting a commercial real estate license is a structured process, but it’s not overly complicated. Here’s a simplified guide to help you understand the steps involved and the requirements you need to meet.

Table of Common Requirements for Commercial Real Estate Licensure:

| Requirement | Details |

| Age | Must be at least 18 years old (varies slightly by state). |

| Residency | Must be a U.S. resident or legal immigrant. |

| Background Check | Must pass a criminal background check (usually no felonies). |

| Education | Complete a state-approved real estate course (typically 60-180 hours). |

| Real Estate Exam | Pass a state-administered licensing exam on real estate law and practices. |

| Application | Submit your application, exam results, and proof of education to the state. |

| Sponsoring Broker | Often required to work under a licensed broker before receiving the license. |

| Continuing Education | Complete ongoing courses to maintain your license (usually every 2-4 years). |

| Commercial Real Estate Certification | Optional certifications, such as CCIM, for specialization in commercial real estate. |

How to Calculate Commercial Real Estate Rent

Calculating commercial real estate rent involves determining the price tenants will pay to lease a property, typically based on factors like the amount of space, the lease structure, and market conditions. Here’s a breakdown of how to calculate commercial rent:

Calculating commercial real estate rent involves determining the price tenants will pay to lease a property, typically based on factors like the amount of space, the lease structure, and market conditions. Here’s a breakdown of how to calculate commercial rent:

1. Determine the Lease Type

There are different lease structures, and each impacts how rent is calculated. The most common types are:

- Gross Lease: The landlord covers most or all operating expenses (e.g., taxes, insurance, maintenance), and the tenant pays a flat rent.

- Net Lease: The tenant pays a base rent plus some or all of the property’s operating expenses. Net leases can be single net (N), double net (NN), or triple net (NNN), depending on what expenses the tenant covers.

- Percentage Lease: The tenant pays a base rent plus a percentage of their sales if they exceed a certain threshold.

2. Calculate the Rent Per Square Foot

Commercial rent is often quoted in terms of rent per square foot (SF). To calculate it:

- Step 1: Determine the rental rate per square foot. This could be based on market comparisons or the property’s value.

Example: If similar properties in the area are renting for $20 per SF annually, that becomes your base rate.

- Step 2: Multiply the square footage of the space by the rent per square foot.

Example: If you have a 2,000 SF space and the rent is $20/SF per year:

2,000 SF×20 USD/SF=40,000 USD/year2,000 \, \text{SF} \times 20 \, \text{USD/SF} = 40,000 \, \text{USD/year}

This means the tenant would pay $40,000 annually or $3,333.33 monthly.

3. Include Operating Expenses (for Net Leases)

If the lease is a net lease, the tenant also pays their share of the property’s operating expenses. To calculate these:

- Step 1: Determine the total operating expenses (e.g., taxes, insurance, maintenance).

Example: If the annual operating expenses total $10,000 for the property, and the tenant rents 25% of the space, they would be responsible for 25% of that cost:

10,000 USD×25%=2,500 USD/year10,000 \, \text{USD} \times 25\% = 2,500 \, \text{USD/year}

- Step 2: Add the operating expenses to the base rent. If the base rent is $40,000 and the tenant owes $2,500 in operating expenses:

40,000 USD+2,500 USD=42,500 USD/year40,000 \, \text{USD} + 2,500 \, \text{USD} = 42,500 \, \text{USD/year}

This means the tenant would pay $42,500 annually or $3,541.67 monthly.

4. Consider Rent Escalations

Many commercial leases include escalation clauses that adjust rent over time to keep up with inflation or increases in operating costs. Common types of escalations include:

- Fixed Percentage: Rent increases by a fixed percentage (e.g., 5% annually).

- CPI (Consumer Price Index): Rent increases based on inflation rates as measured by the CPI.

To calculate rent with an escalation clause, apply the percentage increase to the original base rent each year.

5. Factor in Additional Costs

If applicable, add any other costs to the calculation, such as:

- Common Area Maintenance (CAM) Fees: In many commercial properties, tenants share the cost of maintaining common areas (lobbies, hallways, parking).

- Utilities: If the tenant is responsible for utilities like electricity, water, or internet, those costs need to be added to the rent.

Example of Full Calculation:

- Base Rent: $20/SF

- Square Footage: 2,000 SF

- Operating Expenses (NNN): $2,500 annually (tenant’s share of property expenses)

- Total Rent: $40,000 (base rent) + $2,500 (operating expenses) = $42,500/year or $3,541.67/month.

Key Points:

- Base Rent: Calculated by multiplying the square footage by the rent per square foot.

- Operating Expenses: Additional costs in net leases are added to the base rent.

- Escalations: Rent increases over time due to inflation or contract terms.

- Additional Fees: Consider CAM fees, utilities, and other costs if applicable.

By following these steps, you can calculate the total commercial rent that a tenant will pay.

What is an OM in Commercial Real Estate?

An OM (Offering Memorandum) in commercial real estate is a detailed document that provides potential investors or buyers with key information about a property for sale. It typically includes financial data, property features, lease information, market analysis, and any risks or opportunities associated with the investment. The OM is often used to help potential buyers evaluate whether the property aligns with their investment goals and to make an informed purchasing decision.

How to Find Off-Market Commercial Real Estate

Finding off-market commercial real estate involves searching for properties that are not publicly listed or advertised for sale. Strategies to find these deals include networking with real estate brokers, attending industry events or property auctions, leveraging direct mail campaigns, reaching out to owners directly through cold calling or email, and using commercial real estate platforms that specialize in off-market opportunities. Off-market deals often provide investors with the chance to negotiate better terms and avoid competition.

How Much Does Commercial Real Estate Appreciate Per Year?

The appreciation rate of commercial real estate varies based on factors like location, property type, and market conditions. On average, commercial properties appreciate at a rate of about 3% to 5% annually, though it can be higher in prime markets or lower in less desirable areas. Economic conditions, supply and demand, and interest rates all play a significant role in determining the rate of appreciation. Investors should consider these variables when projecting potential returns on commercial real estate investments.

How to Become a Commercial Real Estate Appraiser

To become a commercial real estate appraiser, you typically need to complete several steps. First, you must meet your state’s educational requirements, which usually include completing a pre-licensing course and gaining practical experience under a licensed appraiser. Afterward, you must pass a state certification exam. Depending on your state, you may need to work as a trainee appraiser for a period of time to gain experience before becoming fully certified. Additional certifications and education may be required to specialize in commercial real estate appraisal.

How to Break into Commercial Real Estate

Breaking into commercial real estate requires a combination of education, experience, and networking. A common starting point is to pursue a degree or coursework in real estate, business, or finance. Getting hands-on experience through internships, working as a leasing agent, or partnering with established brokers can also help. Networking is key in this industry, so attending industry events, joining professional associations, and building relationships with other real estate professionals is important. Over time, developing expertise in specific areas like property management or investment analysis can help you advance in commercial real estate.

What is RSF in Commercial Real Estate?

RSF stands for Rentable Square Feet in commercial real estate, which refers to the total area in a commercial building that a tenant pays rent for. It includes both the usable space (the area the tenant can directly occupy) and a proportionate share of the building’s common areas, like hallways, restrooms, and lobbies. RSF is important in lease negotiations and calculating rental rates, as tenants are typically charged based on the RSF, which is a larger figure than the usable square feet (USF).

DE Commercial Real Estate

DE Commercial Real Estate likely refers to the commercial real estate market or practices in Delaware (DE). Delaware has a robust commercial real estate market, driven by factors such as its business-friendly tax laws, proximity to major markets like Philadelphia, and its appeal as a hub for corporate headquarters. Investors in Delaware commercial real estate benefit from the state’s low taxes and legal protections for businesses, which make it an attractive market for both local and out-of-state investors.

Market Trends and Future Outlook in Commercial Real Estate

Current Trends

The commercial real estate landscape is constantly evolving, with key trends shaping investment and development. The rise of e-commerce has significantly impacted retail spaces, leading to a decline in traditional brick-and-mortar stores while increasing demand for warehouses and distribution centers. Meanwhile, the office market is shifting as businesses seek flexible office spaces, co-working environments, and hybrid work models, reducing the need for large, permanent office setups.

Technology Impact

Technology is transforming the industry through PropTech (Property Technology), which enhances operations, tenant experiences, and investment decisions. Tools like AI-driven analytics, smart building management systems, and virtual property tours streamline transactions and improve efficiency. Blockchain and digital transactions are also making property buying, leasing, and financing more transparent and secure.

Sustainability

Environmental concerns are pushing commercial real estate toward green buildings and sustainable practices. Investors and tenants now prioritize LEED-certified buildings, energy-efficient systems, and eco-friendly designs. Governments and corporations are incentivizing sustainability through tax benefits, regulations, and carbon footprint reduction initiatives, making it a crucial factor in real estate development.

Future Predictions

The future of commercial real estate will be driven by urbanization, technological advancements, and shifting work dynamics. The demand for logistics and industrial spaces will continue to grow due to e-commerce expansion. Office spaces will likely become more adaptive and experience-driven, while retail will focus more on experiential shopping rather than just transactions. Sustainability and ESG (Environmental, Social, Governance) factors will become even more critical in investment decisions. Additionally, the integration of AI and automation will redefine property management, tenant engagement, and valuation processes.

In summary, commercial real estate is adapting to new economic realities, digital transformation, and sustainability goals. Investors and businesses that embrace these changes will be best positioned for future growth.

Tips for Success in Commercial Real Estate

1. Research and Due Diligence

One of the most important aspects of succeeding in commercial real estate is conducting thorough research and due diligence. Before making any investment or decision, it’s essential to gather detailed information about the property, market conditions, and potential risks. Analyze the property’s financials, including income, expenses, and market value, and assess the local economy, zoning laws, and future developments. The more research you do upfront, the better prepared you’ll be to make informed decisions and avoid costly mistakes.

2. Location

In commercial real estate, location is paramount. The success of a property, whether it’s an office building, retail space, or industrial facility, is heavily influenced by its location. High-traffic areas, proximity to key business hubs, accessibility, and local economic health all play a critical role in a property’s value and long-term viability. It’s important to evaluate the surrounding area’s potential for growth or decline, as well as local market trends, to ensure you’re investing in a prime location.

3. Networking

Building relationships with industry professionals is essential for success in commercial real estate. Networking helps you gain access to off-market deals, insider information, and valuable partnerships. Develop a network of real estate brokers, property managers, attorneys, investors, and contractors to tap into different areas of expertise. Attending industry events, joining associations, and staying active in professional groups will expand your network and provide opportunities that may not be available through traditional channels.

4. Professional Advice

Consulting with real estate experts and financial advisors is crucial to navigating the complexities of the commercial real estate market. These professionals can provide valuable insights into property valuation, market trends, financing options, and legal considerations. A good real estate broker can help you find the right properties, while a financial advisor can assist with tax planning and investment strategies. Relying on expert advice ensures that you avoid common pitfalls and make well-informed decisions that align with your investment goals.

By focusing on thorough research, strategic location, networking, and expert advice, you’ll position yourself for success in the competitive world of commercial real estate.

Conclusion

Commercial real estate (CRE) is an integral part of our economic fabric, influencing everything from job creation to the way cities are designed and built. Whether you’re considering office buildings, industrial warehouses, or multifamily housing, CRE offers a wealth of opportunities for investors looking to build wealth over time. However, it’s important to understand that this industry is constantly changing. Trends such as the rise of e-commerce, shifts in work environments, and sustainability initiatives are all reshaping how and where we invest. The increasing role of technology, from AI to PropTech, is also enhancing how deals are made and properties are managed.

Investing in commercial real estate can provide long-term benefits such as steady income and capital appreciation, but it’s not without its challenges. It requires careful analysis, a solid strategy, and the ability to adapt to market shifts. In the end, success in CRE isn’t just about identifying prime locations or relying on market conditions—it’s about being informed, staying proactive, and having the right people in your corner. Whether you’re just starting out or already have experience in the sector, having a comprehensive understanding of CRE and its evolving landscape will empower you to make smarter investment decisions and achieve sustainable growth.

Frequently Asked Questions

What is a typical commercial real estate commission for buyer agency?

Commercial real estate commissions vary depending on the property type, location, and deal size. Typically, a buyer's agent in commercial real estate receives a commission ranging from 2% to 5% of the transaction value. In some cases, the commission structure may be negotiated between the agent and the client, and sometimes the commission is shared with the seller's agent. It's essential for buyers to clarify commission terms before entering into an agreement.

How do commercial real estate agents get paid?

Commercial real estate agents are typically compensated through commissions, which are a percentage of the final sale or lease transaction. The commission is usually paid by the property seller or landlord, but the amount is often split between the buyer's agent and the seller's agent. In leasing deals, agents can earn a commission based on the lease value over the contract term. Some agents may also receive a fixed salary or a mix of salary and commission depending on the employer.

Can you do both commercial and residential real estate?

Yes, it is possible to work in both commercial and residential real estate. Many agents and brokers hold licenses for both sectors. However, commercial real estate and residential real estate require different skill sets, market knowledge, and expertise. Balancing both sectors can be challenging, but for those with diverse interests and the necessary expertise, it can be a rewarding way to broaden their business opportunities.

How much down payment is required for commercial real estate?

The down payment required for commercial real estate typically ranges between 20% and 30% of the purchase price. This percentage can vary depending on factors like the type of property, the buyer’s financial situation, and the lender's requirements. For investment properties, lenders may ask for higher down payments, while owner-occupied properties may have more flexible down payment options. Some programs, such as SBA loans for small businesses, may also offer lower down payment requirements.

Is commercial real estate a good career?

A career in commercial real estate can be highly rewarding for those with the right skills, work ethic, and drive. It offers potential for high earnings through commissions, as well as opportunities to work in diverse sectors such as office space, industrial properties, retail, and multifamily housing. The industry can be challenging, especially in terms of market volatility and long sales cycles, but for individuals who are proactive, network well, and stay updated on industry trends, it can provide a fulfilling and lucrative career.

How much does a commercial real estate appraisal cost?

The cost of a commercial real estate appraisal can vary depending on the property’s size, location, complexity, and the type of appraisal required. Typically, commercial appraisals range from $2,000 to $10,000 or more. Larger and more complex properties such as multi-family units, office buildings, or industrial properties may incur higher costs. It's best to obtain quotes from certified appraisers to get a more accurate estimate based on the specifics of the property.

What is not considered commercial real estate?

Commercial real estate refers to properties used for business purposes, including office buildings, retail spaces, industrial properties, and multifamily housing. Properties not considered commercial real estate typically include single-family homes, agricultural land, and properties used exclusively for residential purposes. Residential properties, where the primary use is for people to live, do not fall under the commercial real estate category.

Is Airbnb a commercial property?

An Airbnb property can be considered commercial property if it is used as a business for profit, typically involving short-term rentals. While many Airbnb listings are residential in nature, the property itself may be classified as commercial if it is managed as a business entity. The classification depends on how the property is operated, local zoning regulations, and whether the owner rents out the space regularly as part of a business venture.

What is a good length of time for a commercial lease?

The typical length of a commercial lease can vary, but most leases last between 3 and 10 years. Shorter leases (3 to 5 years) are common for businesses with less certainty or those just starting. Longer leases (7 to 10 years) are often negotiated by established businesses that want long-term security. The ideal length depends on the business's needs, the stability of the location, and market conditions.

What is contribution by limits in commercial liability?

Contribution by limits is a concept used in commercial liability insurance when multiple policies or insurers are involved. It refers to the way in which each insurance policy contributes to a claim. Each insurer’s contribution is limited to the amount specified in their respective policy, ensuring that no one policy covers more than its limit. This method helps ensure that liability is shared proportionally among insurers, depending on the terms and limits of their coverage.

Can a dwelling policy be used for commercial purposes?

No, a dwelling policy is specifically designed for residential properties and is not meant to cover commercial properties. A dwelling policy provides coverage for personal property in residential buildings, such as single-family homes or small rental properties. For commercial properties, businesses should obtain a commercial property insurance policy, which is tailored to cover the unique risks associated with commercial operations.

What is lis pendens in real estate?

A lis pendens is a notice of pending legal action related to a specific property. It is typically filed in the county records to inform potential buyers or other interested parties that a lawsuit or claim has been filed involving the property. This notice can affect the marketability of the property, as it signals that ownership may be disputed or under legal scrutiny. Buyers should be cautious when considering properties with a lis pendens, as it can complicate or delay the sale.

Glossary of Commercial Real Estate Terms

| Term | Definition |

|---|---|

| Commercial Real Estate (CRE) | Properties used for business activities or income generation, such as offices, retail spaces, industrial warehouses, and multifamily housing. |

| Net Operating Income (NOI) | The total income generated from a property minus operating expenses, excluding debt service and taxes. Used to assess profitability. |

| Capitalization Rate (Cap Rate) | A metric used to evaluate the return on investment (ROI) of a property, calculated as NOI divided by the property’s purchase price or market value. |

| Cash on Cash Return | A measure of the annual cash flow generated by a property relative to the cash invested, expressed as a percentage. |

| Debt Service Coverage Ratio (DSCR) | A financial metric that measures a property’s ability to cover its debt obligations, calculated as NOI divided by annual debt payments. |

| Gross Lease | A lease agreement where the landlord covers most or all operating expenses, and the tenant pays a flat rent. |

| Net Lease | A lease agreement where the tenant pays a base rent plus some or all of the property’s operating expenses (e.g., taxes, insurance, maintenance). |

| Triple Net Lease (NNN) | A type of net lease where the tenant is responsible for property taxes, insurance, and maintenance costs in addition to rent. |

| Percentage Lease | A lease agreement where the tenant pays a base rent plus a percentage of their sales if they exceed a certain threshold. |

| Rentable Square Feet (RSF) | The total area in a commercial building that a tenant pays rent for, including usable space and a share of common areas. |

| Usable Square Feet (USF) | The actual space a tenant can occupy and use for their business operations. |

| Escalation Clause | A provision in a lease agreement that allows for rent increases over time, often tied to inflation, market rates, or operating costs. |

| Common Area Maintenance (CAM) Fees | Fees charged to tenants for the maintenance and upkeep of shared spaces in a commercial property, such as lobbies, parking lots, and hallways. |

| Offering Memorandum (OM) | A detailed document provided to potential buyers or investors, outlining key information about a commercial property for sale, including financials, property features, and market analysis. |

| Real Estate Investment Trust (REIT) | A company that owns, operates, or finances income-producing real estate. REITs allow investors to buy shares and earn dividends from rental income. |

| Special Purpose Property | A property designed for a unique, singular use, such as a hotel, hospital, or amusement park, making it difficult to repurpose without significant modifications. |

| Specialty Property | A property designed for a specific use or market but with more flexibility than special purpose properties, such as data centers, self-storage facilities, or fitness centers. |

| Lis Pendens | A legal notice filed in public records indicating that a lawsuit or claim has been filed involving a specific property, affecting its marketability. |

| PropTech (Property Technology) | Technology used to enhance real estate operations, tenant experiences, and investment decisions, including AI, smart building systems, and virtual property tours. |

| 1031 Exchange | A tax-deferred exchange that allows investors to sell a property and reinvest the proceeds into a similar property, deferring capital gains taxes. |

| Self-Directed IRA (SDIRA) | A retirement account that allows individuals to invest in alternative assets, such as commercial real estate, using their retirement funds. |

| Hard Money Loan | A short-term, high-interest loan secured by the property’s value, often used for quick acquisitions or renovations. |

| Syndication | A real estate investment strategy where multiple investors pool funds to purchase a property, with a managing partner overseeing the investment. |

| Crowdfunding | A method of raising capital from a large number of investors, typically through online platforms, to fund commercial real estate projects. |

| Zoning Laws | Regulations that dictate how land and buildings can be used in specific areas, such as residential, commercial, or industrial purposes. |