Real estate is everywhere—it’s the land we live on, the homes we buy, and the offices we work in. But what exactly is real estate, and why is it so important? Whether you’re thinking about buying your first home, investing in property, or just curious about how it all works, this guide will break it down in simple terms. Let’s dive in!

What is Real Estate?

Real estate is property that includes:

- Land: Empty plots, farms, or forests.

- Buildings: Houses, apartments, offices, and factories.

- Natural Resources: Things like water, minerals, or crops on the land.

Real estate is unique because it can’t be moved (you can’t pick up a house and take it somewhere else!), and it usually grows in value over time. Real estate includes both the physical land and any permanent structures attached to it.

History of Real Estate

Real estate has been around for thousands of years. In ancient times, land ownership was a sign of power and wealth. Kings and nobles owned vast lands, while common people worked on them. Over time, systems for buying, selling, and owning property evolved. Today, the real estate market is a global industry that impacts everyone, from homeowners to big investors.

Types of Real Estate

Real estate includes several categories, each with its own purpose:

| Type of Real Estate | Description | Examples |

|---|---|---|

| Residential Real Estate | Homes where people live | Single-family homes, apartments, townhouses |

| Commercial Real Estate | Properties used for business | Offices, malls, restaurants |

| Industrial Real Estate | Places for manufacturing or storage | Factories, warehouses |

| Land | Undeveloped or agricultural land | Farms, empty plots |

| Special Purpose Real Estate | Properties with a specific use | Schools, churches, parks |

How Real Estate Works

The real estate market is where buyers and sellers come together to trade property. Here’s how it works:

- Buyers: People who want to buy a home or invest in property.

- Sellers: People who want to sell their property.

- Real Estate Professionals: Agents, brokers, and developers who help facilitate real estate transactions.

- Real Estate Brokerage: Firms that connect buyers and sellers, often through licensed agents.

- Lenders: Banks or financial institutions that provide loans to buy property.

The market goes up and down based on things like:

- How many people want to buy or sell.

- Interest rates (the cost of borrowing money).

- The overall economy.

Modernization of Real Estate

Real estate is changing fast, thanks to technology and new trends:

- Proptech: Apps and platforms that make buying, selling, and managing property easier.

- Smart Homes: Houses with advanced technology for security, energy efficiency, and convenience.

- Virtual Tours: Buyers can now explore properties online without visiting in person.

- Sustainability: Green buildings and eco-friendly designs are becoming more popular.

- Remote Work: With more people working from home, demand for home offices and larger spaces is growing.

Investing in Real Estate

There are many ways to get started in investing in real estate:

| Investment Type | Description | Pros | Cons |

|---|---|---|---|

| Buying a Home | Purchase a property to live in or rent out | Steady income, long-term value growth | High upfront costs |

| Rental Properties | Buy a property and rent it to tenants | Monthly cash flow, tax benefits | Requires management |

| Flipping Houses | Buy, renovate, and sell for profit | High potential returns | Risky, time-consuming |

| REITs | Invest in companies that own properties | No need to manage property | Lower control over investments |

| Crowdfunding | Pool money with others to buy property | Low initial investment | Limited liquidity |

Difference Between a Real Estate Agent and a Realtor

- Real Estate Agent: A licensed professional who helps people buy, sell, or rent properties.

- Realtor: A real estate agent who is a member of the National Association of Realtors (NAR) and follows a strict code of ethics.

- In short, all Realtors are real estate professionals, but not all real estate agents are Realtors.

How to Get a Basic Understanding of Real Estate Law

Real estate law can seem complicated, but here are the basics:

- Property Rights: Understand what you can and cannot do with your property.

- Contracts: Learn how buying and selling agreements work.

- Zoning Laws: Rules about how land can be used (e.g., residential vs. commercial).

- Taxes: Know about property taxes and how they affect you.

- Disclosures: Sellers must share important information about the property (e.g., repairs needed).

- Tenant Rights: If you’re renting out property, understand the laws protecting tenants.

Challenges of Real Estate

While real estate can be a great investment, it’s not without risks:

- Costs: Buying and maintaining property can be expensive.

- Market Changes: Property values can go down during a recession.

- Time-Consuming: Managing rentals or renovations takes effort.

- Liquidity: It’s harder to sell property quickly compared to stocks.

Trends in Real Estate

The real estate market is always changing. Here are some trends to watch:

| Trend | Description | Impact |

|---|---|---|

| Technology | Virtual tours, online listings | Easier buying and selling |

| Sustainability | Green buildings, eco-friendly designs | Increased demand for eco-homes |

| Remote Work | More people working from home | Higher demand for home offices |

| Co-Living | Shared living spaces | Popular among millennials and Gen Z |

Tips for First-Time Investors

If you’re new to investing in real estate, here are some tips:

- Start Small: Buy a single property before expanding.

- Research: Learn about the market and location before buying.

- Work with Professionals: Hire a good real estate agent or advisor.

- Plan for Costs: Don’t forget about taxes, repairs, and maintenance.

- Be Patient: Real estate is a long-term investment.

Note: Be careful of real estate fraud

The Future of Real Estate

The future of real estate looks exciting! Here’s what to expect:

- Smart Homes: Houses with advanced technology for security and energy efficiency.

- Green Buildings: More eco-friendly designs and materials.

- Urban Growth: Cities will continue to grow, but suburbs may also become more popular.

- New Investment Options: More ways to invest, like crowdfunding and REITs.

- Earn Passive income: You can earn passive income through a real estate business.

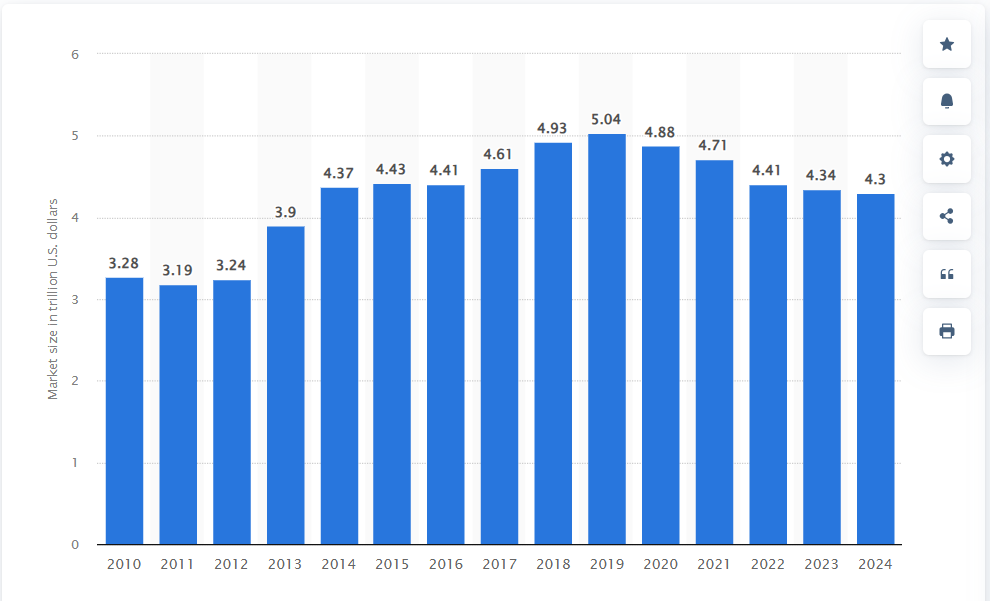

Real Estate Market Growth

Size of the global commercial real estate market from 2010 to 2024

(in trillion U.S. dollars) “Source“

Table 1: Comparison of Real Estate Investment Options

| Investment Type | Initial Cost | Risk Level | Potential Return |

|---|---|---|---|

| Buying a Home | High | Medium | High |

| Rental Properties | Medium | Medium | Medium |

| Flipping Houses | High | High | High |

| REITs | Low | Low | Medium |

| Crowdfunding | Low | Medium | Medium |

Conclusion

Real estate is more than just buying and selling property—it’s about creating homes, building businesses, and making smart investments. Whether you’re a first-time buyer or an experienced investor, understanding real estate can help you make better decisions. So, what’s your next step? Start exploring the real estate market, talk to real estate professionals, and take the first step toward your real estate goals!

Follow Dream Renew for the latest information on real estate!

Frequently Asked Questions

What is the simplest way to invest in real estate?

Buying a home or investing in REITs are great starting points. REITs allow you to invest in real estate without owning physical property.

Can I invest in real estate with little money?

Yes! Crowdfunding and REITs allow you to start small. Some platforms let you invest with as little as $500.

What’s the biggest risk in real estate?

Market downturns can lower property values, so it’s important to research before investing. Additionally, unexpected costs like repairs or vacancies can impact your returns.

Is real estate a good long-term investment?

Yes, property values tend to grow over time, making it a solid long-term choice. Historically, real estate has outperformed many other investment types over the long run.

Which type of real estate makes the most money?

Commercial real estate includes different types of buildings, like offices, stores, and factories. These buildings can make more money than houses because businesses rent them for a long time and need more space.