Buying a house can feel confusing, especially once paperwork starts piling up. The Real Estate Settlement Procedures Act, often called RESPA, helps take the guesswork out of closing a sale. It protects buyers and sellers from unfair practices and hidden costs, making the process smoother and more predictable.

What is the Real Estate Settlement Procedures Act (RESPA)?

RESPA is a federal law, signed in 1974, aimed right at the heart of murky, unfair lending and closing practices. Before RESPA, homebuyers often faced hidden fees, surprise charges, or worse kickbacks between service providers that could jack up closing costs with no benefit to the buyer.

Congress passed RESPA to force transparency and honesty in the home settlement (closing) process. The law makes sure buyers get clear information about all the costs involved in their real estate transaction. It also bans shady deals, like sneaky referral fees, so buyers know everyone’s playing fair. For an in-depth look straight from the experts, check out the Real Estate Settlement Procedures Act (RESPA) overview at the National Association of Realtors.

The heart of RESPA beats everyday buyers. Its focus: clear information, fewer surprises, and no sneaky add-on fees. It’s been updated several times, but its main goal hasn’t changed to protect the people buying or refinancing a home.

Core Protections and Coverage

Most home loans used to buy, build, or refinance a house fall under RESPA. This includes big names like FHA, VA, and conventional loans from private lenders. If you’re borrowing for a single-family home, condo, or even a manufactured home, chances are RESPA covers you.

What does RESPA not cover?

Here are a few exceptions:

- All-cash deals (no mortgage)

- Large multi-unit properties (over four units)

- Vacant land

- Business or commercial properties

RESPA’s biggest protections include:

- Required disclosures from lenders on all settlement costs and practices

- A ban on kickbacks and hidden referral fees between lenders, agents, and closing service providers

- Limits on how much money lenders can keep in escrow accounts for taxes and insurance

A familiar example: Before RESPA, a lender might have steered buyers to a specific title company and then pocketed a secret fee for the referral. RESPA makes that illegal and requires all such business relationships to be openly disclosed. You can read the full text of RESPA at the Federal Reserve.

Who Enforces RESPA and How It Has Changed

Today, the Consumer Financial Protection Bureau (CFPB) enforces RESPA. Over the years, major updates have made RESPA even tougher on shady deals while making the process easier for you.

The most important change: clearer, simpler forms for buyers and borrowers.

- The Loan Estimate and Closing Disclosure replaced the confusing old paperwork (like the Good Faith Estimate and HUD-1).

- These integrated forms make it easier to compare offers and spot fees that change before closing.

The CFPB’s TRID rule (TILA-RESPA Integrated Disclosure) reshaped how lenders give you information, aiming for clarity at every step.

How RESPA Works: Rules Every Borrower Should Know

So what does RESPA mean for you, in practice? Here’s a breakdown of the must-know rules. Whether you’re a first-timer or an old hand, these details help every buyer stay alert and informed as the process unfolds.

Required Disclosures and Forms

Every RESPA loan triggers a series of mandatory disclosures—think of them as a menu of everything you’ll pay, explained in advance.

Key disclosures and when you’ll see them:

- Loan Estimate: Given within three business days of your loan application, this short form lists your estimated rates, monthly payments, fees, and closing costs.

- Closing Disclosure: Provided at least three business days before closing, this form confirms the final terms and costs of your loan. It should match, or closely align with, the earlier Loan Estimate.

- Escrow Statement: Lenders must explain upfront how your taxes and insurance will be handled and give you annual updates.

- Special Info Booklet: Offered early in the process for most home loans, this quick guide introduces the steps ahead.

These forms are designed to be easy to compare. If one lender’s fees seem much higher than another’s, it should jump out at you.

For more on these documents and the law, the CFPB’s guide on TILA-RESPA forms is a clear, trustworthy source.

Rules Against Hidden Fees and Referral Kickbacks

RESPA draws a bright red line around collusion and hidden deals. Service providers—think mortgage brokers, real estate agents, and title companies—can’t swap “under the table” referral fees. The law bans:

- Kickbacks: secret payments for referring buyers to specific companies

- Fee splitting: illegal sharing of fees between parties who didn’t actually perform any work

Why does this matter? Because those hidden payments can drive up your closing costs. If your real estate agent pushes one title company over another, it must be for your benefit—not because they get a back-end payment.

To see the official breakdown on RESPA disclosure requirements, visit RespaNews’s guide on disclosure requirements.

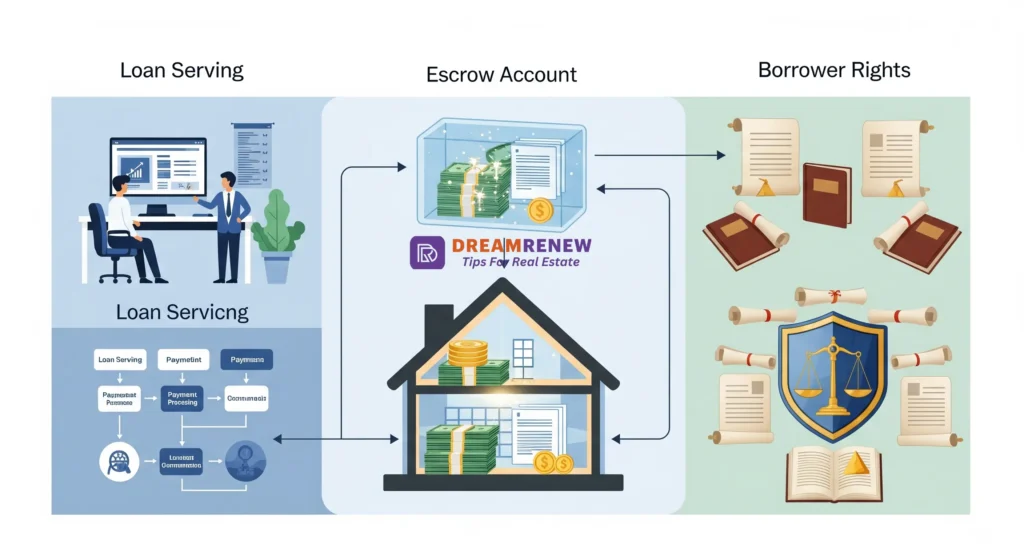

Escrow Accounts, Servicing, and Your Rights as a Borrower

RESPA also polices escrow accounts—the pots of money lenders use to pay your property taxes and insurance. Thanks to RESPA:

- Lenders must clearly explain how escrow accounts work and send yearly statements.

- There’s a strict limit to how much extra money lenders can keep in escrow.

- If your mortgage ever gets sold (servicing transfer), you’ll get advance notice—no more surprise bills from unknown companies.

The law also protects you after closing. If you think your mortgage servicer is making mistakes, RESPA gives you the right to demand answers, in writing, and the company must respond within a set time.

Conclusion

The Real Estate Settlement Procedures Act isn’t just complicated legal speak. It’s the guardrail on your path to homeownership, protecting your wallet and your peace of mind. Whether you’re buying your first house or refinancing a long-loved home, RESPA makes sure you get honest information with up-front disclosures, transparent fees, and no hidden deals.

Read disclosures carefully, ask questions, and know your rights. With RESPA working for you, buyers can move through the closing process feeling confident and in control. If you want to explore more or see the full law for yourself, try checking the official RESPA resource at the Federal Reserve. Knowledge is your best tool—use it to protect your investment and make your next home closing feel less like a mystery and more like a win.

Frequently Asked Questions (RESPA – FAQs)

Who does RESPA apply to?

RESPA covers federally related mortgage loans on residential properties, including purchase loans, refinances, and assumptions. It applies to lenders, mortgage brokers, loan servicers, and many settlement service providers. Business and commercial loans or loans for vacant land are usually exempt.

What disclosures are mandated by RESPA?

Lenders must provide specific disclosures: a Loan Estimate (formerly Good Faith Estimate) within three business days of receiving a loan application, and a Closing Disclosure (formerly HUD-1) before settlement. These documents outline projected and final costs, helping consumers compare offers and understand their expenses.

How does RESPA address illegal referral fees and kickbacks?

Section 8 of RESPA makes it illegal to give or accept any fee, kickback, or thing of value in exchange for referring settlement service business. Only payment for actual services rendered is allowed. Violations can lead to heavy fines or criminal penalties.

What are “things of value” under RESPA?

“Things of value” include not just money, but also gifts, tickets, trips, discounts, or anything else of tangible benefit. Even non-cash incentives offered for the referral of settlement services can break the law.

What transactions are not covered by RESPA?

RESPA does not apply to commercial or business-purpose loans, temporary financing (like construction loans), or transactions involving vacant land. Loans secured by 25 acres or more are also usually excluded.

Are affiliated business arrangements allowed under RESPA?

Affiliated business arrangements are permitted if the consumer is notified in writing, participation is not required, and no extra fees are charged. All relationships and charges must be transparent and fairly priced.

What are the penalties for violating RESPA?

Anyone who violates RESPA may face civil or criminal penalties. This can include fines up to $10,000 per violation, imprisonment, or being sued by affected consumers for damages.

How do TRID rules relate to RESPA?

TRID (TILA-RESPA Integrated Disclosure) rules merged some RESPA and TILA forms into the Loan Estimate and Closing Disclosure for most mortgages. This streamlines disclosures, making it easier for consumers to compare loan offers and understand closing costs.

How can a consumer file a RESPA complaint?

Consumers can submit a complaint with the Consumer Financial Protection Bureau (CFPB) if they believe a lender or settlement service provider violated RESPA. The CFPB investigates and enforces compliance.

Does RESPA cover marketing services agreements (MSAs)?

MSAs are allowed if they’re for actual marketing services at fair market value, not referrals. Any payment tied to referral activity, or lacking a real service, can violate RESPA. Proper documentation and legal review are advised for MSAs.

Where can I find more information about RESPA compliance?

Visit the Consumer Financial Protection Bureau (CFPB) website or refer to your lender’s disclosures for details. Consult a real estate attorney if you have specific concerns about RESPA compliance in your transaction.