The real estate and land use industry will continue to be influenced by some trends that were accelerated by the COVID-19 pandemic for the next five years. However, other factors such as an aging population, the increasing costs of climate change, a more unstable world, and the expansion of artificial intelligence into new areas of the economy will also become more important. Therefore, even though the housing market may gradually unfreeze as mortgage rates slowly decline from their highs in 2023, the hottest housing markets in 2028 may look a bit different from those in early 2024.

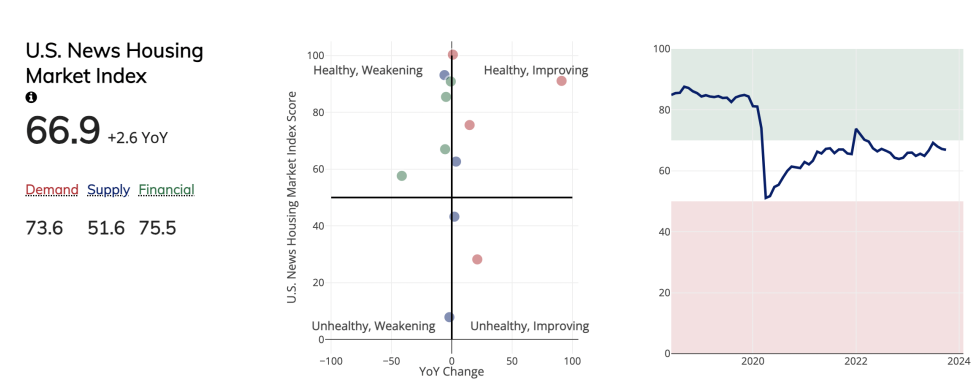

This information was obtained from various reliable sources, including the U.S. News Housing Market Index, which is an interactive platform that provides a data-driven overview of the housing market across the country.

Sales Will Remain Low as the Housing Market Slowly Thaws

A year ago, there was a lot of uncertainty regarding the future of the housing market. Most economists predicted a recession as it was considered difficult to prevent inflation without causing unemployment to rise. However, it turned out that the economists were wrong about the inflation reasons and the US economy has proven to be more resilient than expected. Now, the main questions are how long it will take for inflation to return to 2.0% and for mortgage rates to decrease enough to encourage more home sales.

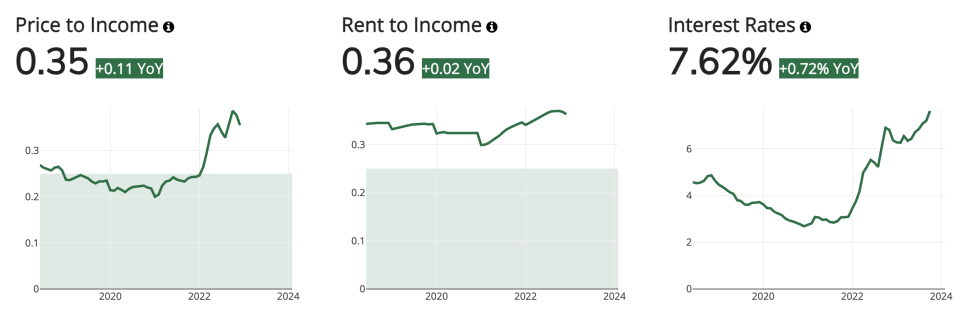

Economists predict that inflation will not fall to 2.0% consistently until 2026, according to the Federal Reserve’s most recent economic projections from December. This could lead to higher but decreasing short-term interest rates for the next two years. However, inflation may continue to decrease steadily until then, resulting in a corresponding drop in mortgage rates. Nevertheless, since nearly 90% of homeowners have mortgage rates below 6%, rates will have to fall significantly below that level to encourage sellers who can afford to wait.

True Home Price Discovery Will Be Delayed

As with any financial asset, the sale price of a home cannot be determined until buyers and sellers agree on a price based on market conditions and financing availability. This process is called price discovery.

However, when a healthy housing market locks up due to a lack of supply or affordable financing, the discovery process is frozen until more transactions occur. Although a few sales can happen, their prices might be skewed due to unique factors such as desperate sellers in financial trouble or stressed-out buyers putting in offers without personally inspecting the properties. True price discovery requires rational buyers and sellers as well as plentiful competition.

In the case of the housing market, the “lock-in effect” of homeowners sitting on the lowest mortgage rates in a generation has been a significant reason for home values holding up better than expected. While some homeowners have no option but to sell their homes due to divorce, death, debt, growing families, job changes, and other reasons, most are waiting for mortgage rates to drop before considering selling.

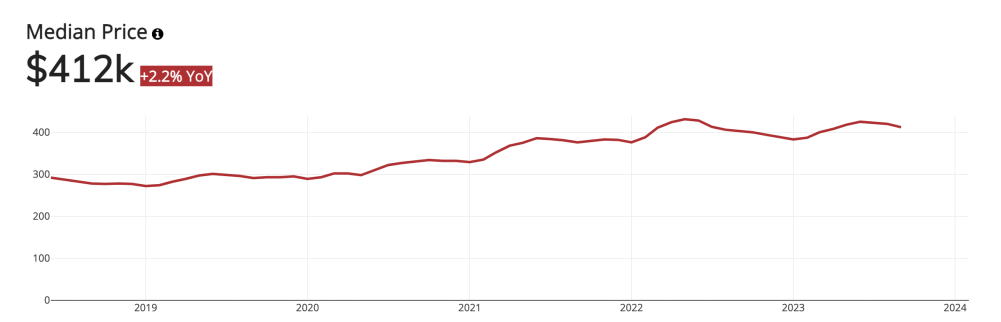

The somewhat artificially low level of inventory for sale over the last two years has helped maintain home values despite higher mortgage rates. As of October, the national S&P CoreLogic Case-Shiller Index, which is the leading measure of U.S. home prices, reached all-time highs after rising 4.8% year-over-year.

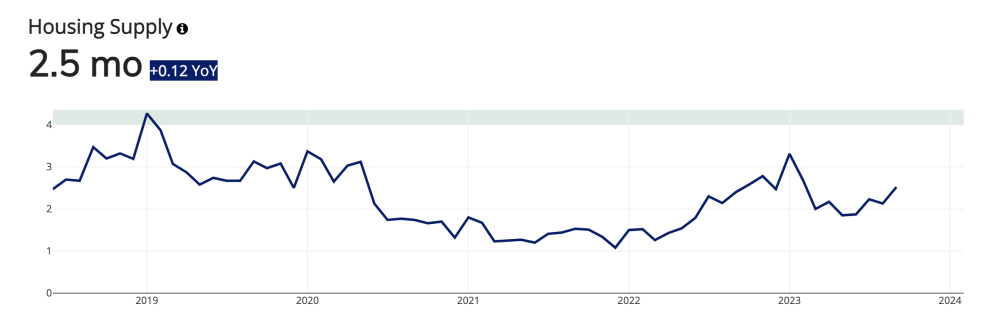

If and when the traditional fixed-rate, 30-year mortgage rate falls below 6%, and especially 5%, the release of more inventory into the marketplace will mean more competition among sellers, ushering in improving price discovery. As inventory returns to healthier levels, such as a supply of 6.0 months versus today’s 3.2 months based on sales rates, home values will adjust accordingly based on the usual inputs of location, size, age, and curb appeal.

Population Changes Return to Pre-Pandemic Trends

The U.S. Census Bureau has recently released new Vintage 2023 population estimates, revealing that regional population changes are returning to the trends observed before 2020, as the COVID-19 pandemic gradually becomes a thing of the past. The changes include fewer deaths and the South dominating this growth.

In 2023, the nation gained more than 1.6 million people, and more states experienced population growth than they did since the start of 2000. Although the South accounted for almost 90% of the annual increase, mostly in Texas and Florida, the West made up most of the balance, with slight increases in the Midwest and a small decline in the Northeast

5-year National Housing Market Predictions for 2024-2028

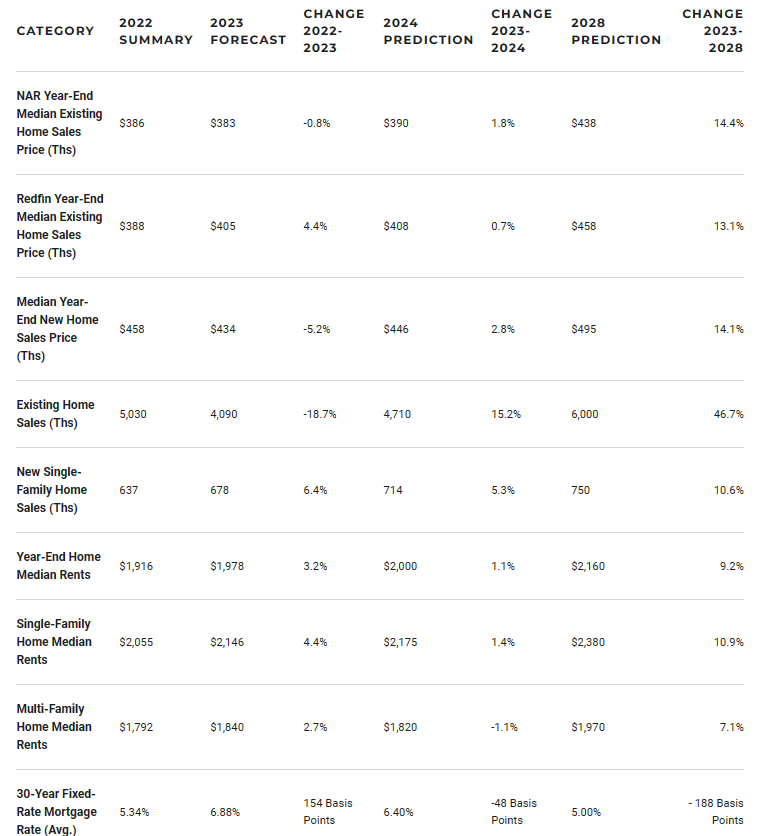

Here is a summary of the year-end 2023 with some predictions for the housing market from 2024 to 2028. Although a recession is not expected, the economic growth rate is projected to decrease significantly from the robust 4.8% seen in the third quarter of 2023. However, if the country were to enter a recession, these predictions would be subject to change.

Housing Market Summary and Predictions

According to the National Association of Realtors, home prices are expected to rebound by 1.8% to $390,000 by the end of 2024, after falling 0.8% year-over-year through December 2023. However, from 2025 to 2028, home prices are predicted to rise gradually at about a percentage point above the rate of inflation, which translates to an estimated increase of 13% to 14% from 2023 levels, due to the large run-up from 2021 through 2023.

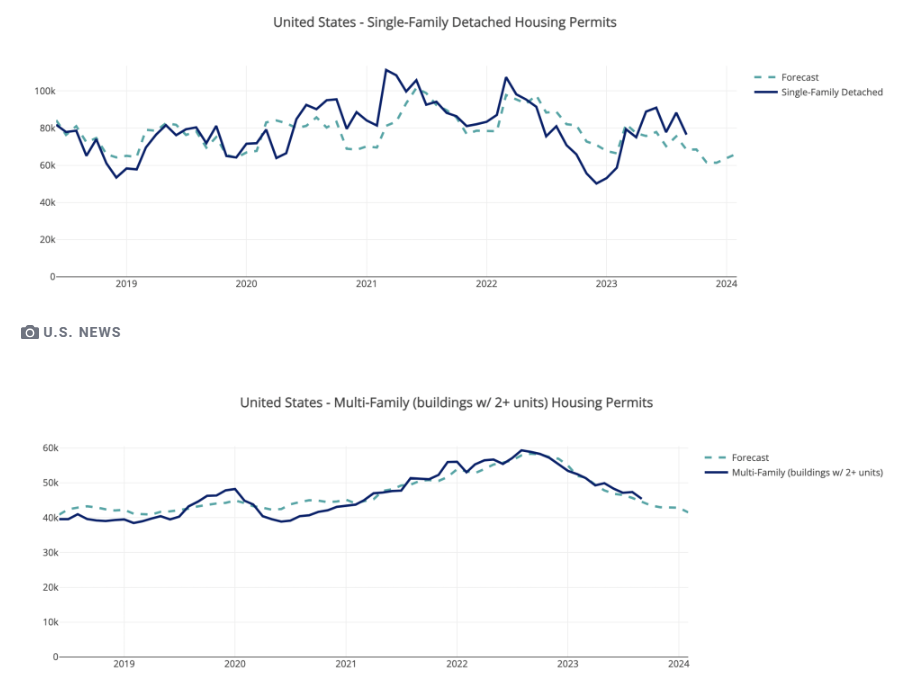

After falling sharply in 2023 to the lowest level since 1995, existing home sales are expected to jump sharply in 2024 and 2025, as mortgage rates fall. This trend is expected to continue through 2028. Sales of new homes, which continued to rise in 2023 due to builders’ ability to buy down mortgage rates to boost affordability, will expand on those gains.

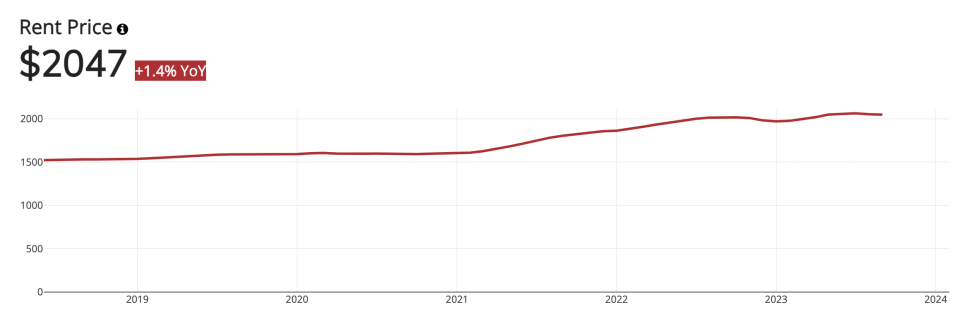

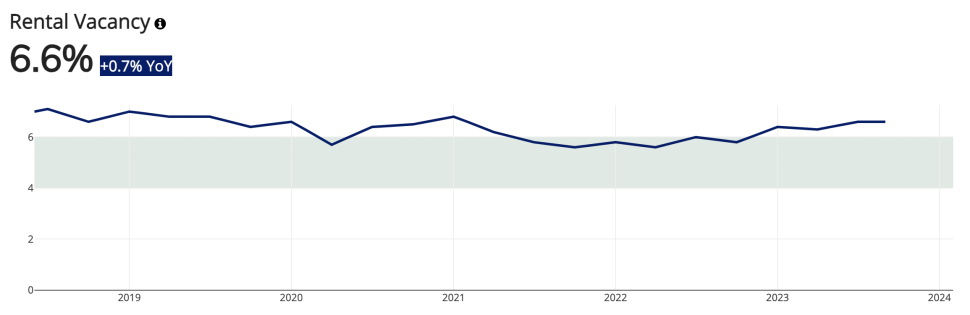

Home rents rose sharply in 2021 and 2022 but continued to rise in 2023 at a much slower pace. For 2024, rents are predicted to remain stable and rise slightly for single-family homes. However, with a significant supply of new multifamily units, apartment rents are expected to fall slightly while offering concessions such as a free month to tenants if they sign a lease. By 2028, rents for single-family homes will rise faster than for multifamily residences, due to the growing popularity of Build-to-Rent homes, as well as the excess supply of apartments taking more time to absorb.

Mortgage rates are predicted to gradually fall over the forecast period. However, they are unlikely to fall under 5.0% due to rising government debt in the U.S. and around the world crowding out the availability of financing for 30-year fixed mortgage rates.