Property taxes play a crucial role in funding local services, schools, and infrastructure. However, real estate tax rates vary widely from state to state. Some states impose high property tax rates, while others have significantly lower tax burdens. In this guide, we’ll explore real estate tax rates by state, highlighting the highest and lowest property tax states in the U.S.

What Are Property Taxes?

Property taxes are fees levied by local governments on real estate properties, including land, homes, and commercial buildings. These taxes are a primary source of revenue for funding essential services like schools, roads, public safety, and infrastructure.

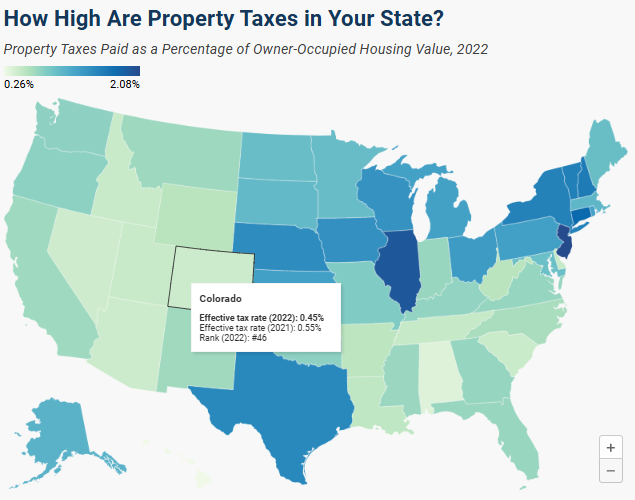

Real Estate Tax Rates by State

The effective property tax rate is calculated as the percentage of a home’s value that homeowners pay annually in taxes. Here’s a breakdown of the average effective property tax rate by state:

| State | Effective Tax Rate |

| New Jersey | 2.33% |

| Illinois | 2.11% |

| New Hampshire | 1.89% |

| Vermont | 1.78% |

| Texas | 1.63% |

| Wisconsin | 1.59% |

| Nebraska | 1.54% |

| Ohio | 1.53% |

| Iowa | 1.49% |

| Pennsylvania | 1.41% |

| Michigan | 1.35% |

| Maine | 1.17% |

| Massachusetts | 1.15% |

| South Dakota | 1.14% |

| Minnesota | 1.05% |

| Maryland | 1.02% |

| Georgia | 0.83% |

| Florida | 0.82% |

| California | 0.71% |

| Tennessee | 0.58% |

| Nevada | 0.50% |

| Alabama | 0.39% |

| Hawaii | 0.27% |

These rates vary due to state policies, cost of living, and alternative revenue sources.

States with the Highest Real Estate Taxes

Some states impose higher property taxes to fund public services, education, and infrastructure. Here are the top 10 states with the highest property tax rates:

- New Jersey – 2.33% (Highest in the U.S.)

- Illinois – 2.11%

- New Hampshire – 1.89%

- Vermont – 1.78%

- Connecticut – 1.73%

- Texas – 1.63%

- Wisconsin – 1.59%

- Nebraska – 1.54%

- Ohio – 1.53%

- Iowa – 1.49%

Why Are Property Taxes High in These States?

- Heavy reliance on property taxes for funding schools and local services

- Lack of state income tax (e.g., Texas and New Hampshire)

- High property values leading to larger tax bills

States with the Lowest Real Estate Taxes

If you’re looking for states with minimal property tax burdens, here are the 10 states with the lowest real estate tax rates:

- Hawaii – 0.27% (Lowest in the U.S.)

- Alabama – 0.39%

- Colorado – 0.49%

- Nevada – 0.50%

- Louisiana – 0.55%

- South Carolina – 0.55%

- Delaware – 0.55%

- West Virginia – 0.55%

- Wyoming – 0.58%

- Tennessee – 0.58%

Why Do These States Have Low Property Taxes?

- Alternative tax structures (e.g., higher sales or tourism taxes)

- Lower cost of living and property values

- Generous tax exemptions and homestead benefits

Are There Any States Without Property Taxes?

While no state completely eliminates property taxes, some states minimize tax burdens through exemptions and alternative tax policies. States like Nevada, Wyoming, and Tennessee have no state income tax and relatively low property tax rates, making them attractive to residents and businesses.

Final Thoughts

Property tax rates can significantly impact the cost of homeownership. Whether you’re looking for a tax-friendly state for retirement or investment, understanding real estate tax rates by state can help you make an informed decision. If you’re considering relocating or investing in real estate, consulting a tax professional for state-specific benefits and deductions is always a smart move.

Which state has the lowest real estate taxes?

Hawaii has the lowest property tax rate at 0.27%, though high property values can offset the savings.

Why are property taxes so high in some states?

States with high property taxes rely more on them to fund public services like education and infrastructure. Some states also have no state income tax, shifting the burden to property owners.

Can property tax rates change over time?

Yes, local and state governments can adjust property tax rates based on budget needs, property assessments, and economic conditions.

Are there ways to lower my property tax bill?

Yes, homeowners may qualify for homestead exemptions, senior discounts, or property tax appeals if they believe their home is overvalued.

Do property taxes vary within a state?

Yes, property tax rates vary by county and municipality within each state, depending on local government funding requirements.

Are property taxes deductible on federal tax returns?

Yes, homeowners can deduct property taxes on federal tax returns, though the deduction is capped under the current tax laws.

How do states with no income tax affect property taxes?

States with no state income tax, like Texas and Florida, often have higher property taxes to compensate for lost revenue.

Which states are the best for retirees in terms of property taxes?

States like Delaware, Wyoming, and South Carolina offer low property tax rates and retirement-friendly tax policies.

How can I find my exact property tax rate?

Check with your county assessor’s office or use online tools provided by state tax agencies to find your local property tax rate.