Within the vast realm of real estate, the commercial sector is a vibrant and intricate area that presents lucrative prospects for both enterprises and investors. This guide tries to provide you a thorough understanding of all the important topics, from basic terminology to intricate specifics of the sector, whether you’re a seasoned player or just getting started in commercial real estate.

What is Commercial Real Estate?

At its core, commercial real estate (CRE) encompasses properties that generate income through rent or capital appreciation. Unlike residential real estate, which involves homes for personal living, commercial real estate involves properties used for business purposes and multifamily houses, Apartments and complex.

Examples of Commercial Real Estate

There are several types of commercial real estate, and each one meets a certain purpose for businesses. Office buildings, retail establishments, industrial complexes, and multifamily housing units are typical examples. Anyone navigating the commercial real estate market has to be aware of these sorts.

Types of Commercial Real Estate

The diversity of commercial real estate is reflected in its types. From retail to hospitality, industrial to office spaces, each type caters to different industries and demands a unique set of considerations.

Commercial Real Estate Asset Types

Assets in the commercial real estate realm can be classified into different categories, including income-producing properties, development properties, and speculative properties. Each type plays a distinct role in the investment portfolio of commercial real estate enthusiasts.

Exploring the Cap Rate

Central to understanding the financial viability of a commercial property is the Capitalization Rate, commonly known as the Cap Rate. This metric provides insights into the potential return on investment and is a crucial factor in decision-making for both buyers and sellers.

The Role of a Commercial Real Estate Broker

Navigating the complexities of commercial real estate often requires the expertise of a professional. A commercial real estate broker serves as a guide, helping clients buy, sell, or lease properties while navigating legal intricacies and market trends.

Decoding Commercial Real Estate Law

Commercial real estate transactions involve legal considerations unique to the industry. From contracts to zoning regulations, a grasp of commercial real estate law is essential for a seamless and lawful property transaction.

Commission Structures in Commercial Real Estate

Understanding how commercial real estate brokers are compensated is vital for both parties involved in a transaction. Commissions can vary, and knowing the structures helps in negotiating fair deals.

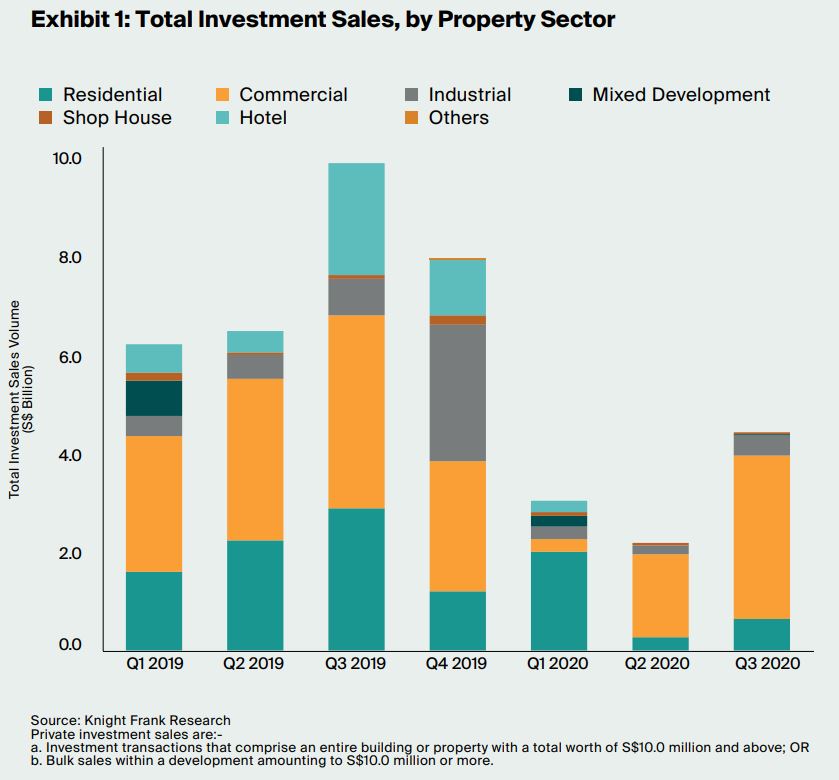

Current Trends in Commercial Real Estate

The commercial real estate market is always changing due to changes in the economy, advances in technology, and world events. Making educated investing selections requires keeping up with the most recent developments.

Unraveling the Core Factor

The core factor in commercial real estate refers to the allocation of common areas within a leased space. Understanding this factor is crucial for both tenants and landlords in negotiating lease agreements.

Opportunity Zones in Commercial Real Estate

An Opportunity Zone is a designation aimed at stimulating economic development in underserved communities. Exploring these zones can unveil unique investment opportunities with potential tax benefits.

Absorption in Commercial Real Estate

The term “absorption” in commercial real estate refers to the rate at which available space is leased in a specific market over a particular period. It is a vital indicator of market activity and demand.

Flex Properties: Adapting to Changing Needs

Flex properties in commercial real estate are designed to be versatile, allowing businesses to adapt to changing operational needs. Understanding the characteristics of flex properties is crucial for businesses seeking flexible space solutions.

Appraising Commercial Real Estate

Determining the value of a commercial property involves a comprehensive appraisal process. Appraisers consider various factors, including location, income potential, and market conditions.

Securing financing is a critical step in acquiring commercial real estate. Understanding the types of loans available, interest rates, and repayment terms is vital for successful property acquisition.

Capitalization Rate: A Key Metric for Investors

Investors often use the capitalization rate to assess the return on investment for a commercial property. It is a fundamental metric that aids in comparing different investment opportunities.

Is Commercial Real Estate a Good Investment in the USA?

Given the dynamic nature of the market, the question of whether commercial real estate is a good investment in the USA requires a nuanced examination of market trends, economic pointers, and individual investment goals. Yes, commercial real estate is good investment in USA because it provides you high ROI. you can buy or list you commercial property at Zillow, Redfin and realtor.com

Timing the Market: When to Buy or Sell

Best time to sell your commercial property it May June and July when market act like a hot market. Buy any property in December or other months when real estate market act like cold market.

The Process of Buying Commercial Real Estate

Buying commercial real estate is a multi-step process that starts with the identification of the property and ends with negotiations and due diligence. A successful deal requires a methodical strategy.

A&E Real Estate: An Insight into Architecture and Engineering

The intersection of architecture and engineering (A&E) with real estate is a fascinating aspect of the industry. A&E professionals play a crucial role in shaping the design and functionality of commercial spaces.

Education Requirements for Real Estate Professionals

While a college degree may not be mandatory for all roles in the real estate industry, specific professions, such as becoming a real estate agent, may have educational requirements. Understanding these requirements is essential for aspiring professionals.

The Importance of Visual Inspection for Real Estate Agents

Real estate agents must conduct visual inspections to assess property conditions accurately. This hands-on approach is crucial for providing clients with accurate information and facilitating transparent transactions.

Conclusion

In this guide, we’ve decoded the complexities of commercial real estate — from property types and financial metrics to legal intricacies and market trends. Whether you’re an investor or a newcomer, success hinges on adaptability, timing awareness, and professional insights.

Frequently Asked Questions

Q1: What is a good cap rate for commercial real estate?

The kind of property and location determine the appropriate capitalization rate (Cap Rate) for commercial real estate. Typically, investors aim for rates in the range of 5% to 10%; however, this can vary based on several factors such as market circumstances, property type, and risk tolerance.

Q2: What is NNN in commercial real estate?

NNN stands for “Triple Net Lease.” It indicates that, in addition to rent, tenants in commercial real estate are also accountable for paying insurance, taxes, and maintenance expenses. Many costs are transferred from the landlord to the tenant under this kind of lease.

Q3: What is CAM in commercial real estate?

CAM refers to “Common Area Maintenance” charges in commercial leases. It includes costs for maintaining shared areas like parking lots and hallways. Tenants may be required to pay to CAM expenses in addition to their base rent.

Q4: What is the current interest rate for commercial real estate?

Commercial real estate interest rates are influenced by various factors, including economic conditions etc. As of November 2023, rates typically range from 3% to 6%, but it’s advisable to check with lenders for the most up-to-date information.

Q5: What is a vanilla shell in commercial real estate?

A vanilla shell, also known as a “white box” or “cold shell,” refers to a commercial space

Next Topic: Selling a House in the USA