Foreclosure is a legal process by which a lender, typically a bank or mortgage company, takes ownership of a property from a defaulter who has failed to meet their mortgage obligations. This failure can include not making mortgage payments on time or in full, leading to a default on the loan.

What is Foreclosure in Real Estate

Foreclosure in real estate is a legal process that allows investors to recover the amount owed on a defaulted loan by taking ownership of and selling the mortgaged property or house.

Why Foreclosure Happens?

Foreclosure happens primarily due to homeowners’ financial struggles, driven by factors like job loss, adjustable mortgage rates, or property depreciation. Predatory lending and legal issues, such as unpaid taxes, can also contribute. External factors like economic downturns or natural disasters can further complex homeowners’ difficulties in making mortgage payments. In essence, it’s a complex interplay of financial, legal, and personal factors that can lead to foreclosure.

How Many Payments Missed Before Foreclosure?

In general, a lender would not begin foreclose until he missed 4 mortgage payment. Time duration can vary from lender to lender as well as state of the housing market at the time. Lender generally prefers to avoid foreclosure because its costly and take too much time.

The names of 4 stages after that foreclosure Proceeds:

- Grace Period

- Notice of Default

- Pre-Foreclosure Period

- Foreclosure Proceedings

What is Foreclosure Type?

Foreclosure processes differ by state to state below are given few foreclosures type:

- Judicial Foreclosure

- Non-Judicial Foreclosure

- Strict Foreclosure

- Power of Sale

- Deed in Lieu of Foreclosure

- Short Sale

According to observation united state have just 2 type of foreclosure process. Half US state work with judicial Foreclosure and other half work with non-judicial foreclosure and some state work with both.

What is Tax Foreclosure?

Tax foreclosure is a process when a property owner fails to pay property taxes, resulting in the government or taxing authority taking ownership of the property to recover the unpaid taxes.

How Does Tax Foreclosure Work

Tax foreclosure is a legal process through which a government or taxing authority takes possession of a property due to unpaid property taxes. Here’s how it typically works:

- Delinquent Taxes: Property owners become delinquent on their property taxes by failing to pay them as required by the tax assessment schedule.

- Notice of Delinquency: The taxing authority will issue a notice of delinquency to the property owner, informing them of the outstanding tax debt and providing a deadline for payment. This notice often includes a grace period for the owner to settle the debt.

- Tax Sale: If the property owner does not pay the delinquent taxes within the specified time frame, the taxing authority may schedule a tax sale or auction. At the tax sale, the property is typically sold to the highest bidder, with the proceeds intended to cover the unpaid taxes and related costs.

- Redemption Period: Some jurisdictions provide a redemption period during which the property owner can pay the delinquent taxes and reclaim the property. The duration of the redemption period varies by location.

- Title Transfer: If the property is not redeemed during the redemption period, the winning bidder or the taxing authority itself may gain ownership of the property. The former property owner loses all rights to the property.

Tax foreclosure is a means for governments to collect unpaid property taxes and ensure the continued funding of public services. The specific rules and timelines can vary by jurisdiction, so property owners facing tax delinquency should familiarize themselves with the local regulations and seek legal advice if necessary to understand their rights and options.

What is Mortgage Foreclosure?

Mortgage foreclosure is a legal process in which a lender takes possession of a property due to the borrower’s failure to meet mortgage payment obligations, typically through non-payment, leading to the sale of the property to recover the outstanding debt.

What is Reverse Mortgage Foreclosure?

Reverse mortgage foreclosure occurs when the borrower of a reverse mortgage, typically an elderly homeowner, is in breach of the terms of the loan agreement. This can happen for various reasons, such as failing to meet property tax and insurance requirements, not living in the home as their primary residence, or not maintaining the property.

The key points to understand about reverse mortgage foreclosure are:

- Loan Repayment Delay: Reverse mortgages allow homeowners aged 62 or older to access the equity in their homes without making monthly mortgage payments. The loan balance grows over time, and repayment is typically due when the homeowner moves out, sells the home, or passes away.

- Breaching Loan Terms: If the homeowner breaches the terms of the reverse mortgage, such as not paying property taxes or homeowners insurance, or failing to live in the home as their primary residence, the loan can be considered in default.

- Servicer Notifications: The reverse mortgage servicer typically sends notices and offers opportunities to resolve the default before initiating foreclosure.

- Foreclosure Process: If the default is not resolved, the reverse mortgage servicer can initiate foreclosure proceedings, which vary by state and may involve the sale of the property to recover the outstanding loan balance.

- Repayment Options: Borrowers or their heirs may have options to repay the loan balance and keep the home, even after the foreclosure process has begun.

Reverse mortgage foreclosure is a complex process, and homeowners or their heirs should seek legal and financial guidance if they are at risk of facing this situation to explore their options and protect their interests.

Top Foreclosure Solutions Providers in United State

Foreclosure solutions providers are changing state to state and county to county few are international solution providers are given as:

- HUD.gov

- USDA-RD/FSA Properties

- IRS Seizures

- Equator

- HomePath

- HomeSteps

- Zillow Foreclosure Center

- Realtor.com

- Bank of America

- Auction.com

- Wells Fargo REO Properties

- CitiMortage

- RealtyBid

- Fifth Third Bank REO

- Huntington REO

How Foreclosure Works

Foreclosure is a legal process that occurs when a borrower is unable to meet their mortgage payment obligations, leading to the lender taking possession of the property to recover the unpaid debt. Here’s a general overview of how foreclosure works:

- Missed Payments: The foreclosure process typically begins when a borrower misses one or more mortgage payments.

- Notice of Default: After missed payments, the lender sends the borrower a notice of default, formally notifying them of the breach of the mortgage agreement.

- Pre-Foreclosure Period: During this stage, the borrower may have the opportunity to resolve the default. They can negotiate with the lender, explore loan modification options, or pay the arrears to bring the mortgage current.

- Foreclosure Lawsuit: If the borrower doesn’t resolve the default, the lender may file a foreclosure lawsuit. The court will review the case, and if the foreclosure is granted, the property can be sold to recover the outstanding debt.

- Auction Sale: In many cases, the foreclosed property is sold at a public auction. The highest bidder acquires the property, and the sale proceeds are used to cover the unpaid mortgage balance and associated costs.

- Bank-Owned Property (REO): If the property does not sell at auction, it becomes bank-owned or “real estate owned” (REO). The lender takes possession of the property and may attempt to sell it through traditional real estate listings.

How To See If A House is in Foreclosure?

To check if a house is in foreclosure, you can follow these steps:

- Online Records Search:

Visit the official website of the county or local government where the property is located. Look for the county recorder’s office or land records department.

Use the property’s address to search for public records related to the property, including foreclosure filings and notices. Some counties offer online databases that allow you to search for property records.

- Public Notices:

Look in local newspapers or on their websites for public notices of foreclosure auctions or sheriff’s sales. These notices typically include details about the property, its address, and the date and location of the sale.

- Property Listing Websites:

Check real estate listing websites such as Zillow, Realtor.com, or local Multiple Listing Services (MLS) for properties that are listed as foreclosures. Real estate agents and brokers often list foreclosed properties for sale.

- Real Estate Agents:

Contact a local real estate agent who specializes in foreclosures. They may have access to information about properties in foreclosure and can assist you in your search.

- Foreclosure Listings Services:

There are online services and companies that specialize in providing foreclosure listings. Some of these services may require a subscription or fee to access their databases.

- Public Records Office:

You can visit the local county recorder’s office or public records office in person to request information about a property’s foreclosure status.

It’s important to note that foreclosure information is typically a matter of public record, and you can access it through these means. However, the availability and accessibility of information may vary by location, and the process may differ from one jurisdiction to another.

Foreclosure Rate in The United States

Nationwide, 0.13%of all housing units (one in every 752) had a foreclosure filing in the first half of 2023, and the top 10 states reporting the highest foreclosure rates in the first half of 2023 were:

- Illinois (0.25% of housing units with a foreclosure filing)

- New Jersey (0.24% of housing units with a foreclosure filing)

- Maryland (0.23% of housing units with a foreclosure filing)

- Delaware (0.23% of housing units with a foreclosure filing)

- Ohio (0.20% of housing units with a foreclosure filing)

- South Carolina (0.19% of housing units with a foreclosure filing)

- Florida (0.19% of housing units with a foreclosure filing)

- Nevada (0.19% of housing units with a foreclosure filing)

- Indiana (0.18% of housing units with a foreclosure filing)

- Connecticut (0.16% of housing units with a foreclosure filing)

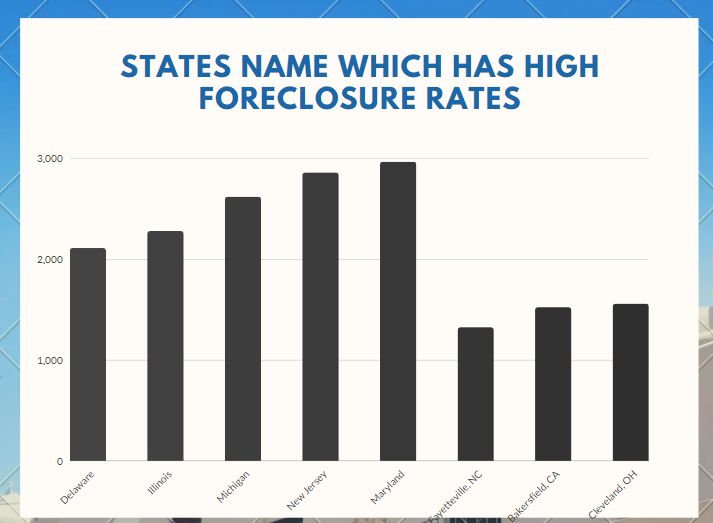

States Name which has High Foreclosure Rates

Few states which have high foreclosure rate are:

Delaware: one in every 2,109 housing units with a foreclosure filing

Illinois (one in every 2,279 housing units); Michigan (one in every 2,617 housing units); New Jersey (one in every 2,858 housing units); and Maryland (one in every 2,967 housing units)

Which is better foreclosure or short sale?

short sale homes are better in condition according to foreclosure homes.

Foreclosure home buyer in United State

Are you facing foreclosure issue and want to sell your house in AS-IS condition for fast cash.

Just search a trusted and reputed homeowner or investor in your state or county because homeowner change area to area. Few foreclosure home owners or companies’ names are:

- Housemaster

- Homesteadroad

- Chase

- Yourbesthomeoffer

- Storyhomebuyers

You can list your property on Zillow, realtor and redfin.

Frequently Asked Questions

Q: Can you get a mortgage on a foreclosure?

Ans: Yes, it is possible to obtain a mortgage to purchase a foreclosed property. Lenders typically offer financing options for buying foreclosures, just as they would for any other property. Keep in mind that the condition of the property and your creditworthiness may affect your ability to secure a mortgage, so it’s essential to have a property inspection and maintain good credit.

Q: What is NJ sales tax?

Ans: NJ stands for New Jersey, and NJ sales tax refers to the sales tax rate in the state of New Jersey. As of my last update in September 2021, the standard sales tax rate in New Jersey was 6.625%. However, sales tax rates and regulations can change, so it’s a good practice to check with the New Jersey Division of Taxation or the state’s official website for the most current sales tax information.

Q: Are foreclosure houses cheaper?

Ans: Yes! Foreclosure houses can be cheaper than similar properties in the real estate market. These properties are typically sold by lenders or at auction to recover outstanding debts, which can lead to lower prices. However, the condition of a foreclosed property can vary, and it may require repairs or renovation, potentially adding to the overall cost.

Q: How long does foreclosure take after being served papers

Ans: The duration of the foreclosure process can vary depending on state and local laws, as well as the specific circumstances of the case. After being served foreclosure papers, it may take several months to over a year or more for the entire foreclosure process to be completed. The borrower may have the opportunity to address the default or seek alternatives during this time.

Q: What is a trustee sale

Ans: A trustee sale, often referred to as a foreclosure auction, is a public sale of a property that occurs when a borrower has defaulted on their mortgage. The sale is typically conducted by a trustee appointed by the lender, and the highest bidder at the auction acquires the property. The proceeds from the sale are used to satisfy the unpaid mortgage debt and associated costs.

Q: What happens to personal property left in a foreclosed home

Ans: Personal property left in a foreclosed home can vary in terms of handling. In many cases, the lender or new property owner may arrange for the removal of personal items, either by working with the former homeowner or through a legal process. However, it’s essential for homeowners to remove their personal belongings before the foreclosure process reaches this point, as leaving personal property in a foreclosed home can result in its loss or disposal.

Next Topic: What Are Tax Liens and How Do They Work